There has been much discussion about the incredible returns Bitcoin has seen over the last decade. This article explores what has driven Bitcoin’s past performance and how these same factors might influence its future price.

By the end, you’ll have a clearer sense of whether buying Bitcoin is right for you, and how it could fit into a broader asset allocation.

Although this guide is written for beginners, it also introduces important personal finance concepts like portfolio allocation and how different assets move in relation to each other.

These are essential ideas for any investor, so we’ve included a section covering them below.

You’ll also come across basic cryptocurrency terms throughout this guide, so it helps to be familiar with them in advance. If you’re new to crypto, check out our Blockchain & Cryptocurrency: A Beginner’s Guide to get up to speed first.

Summary

- Bitcoin has historically returned 168% annually.

- The three biggest drivers of Bitcoin’s success are speculation, scarcity, and the network effect.

- The future performance of Bitcoin is most likely to be driven by speculation. Investors should be confident that more investors will start purchasing Bitcoin, and that existing investors will continue to purchase Bitcoin.

- Bitcoin is a high-risk asset. Investors should be careful not to invest more money than they are willing to lose.

Historical Returns Overview

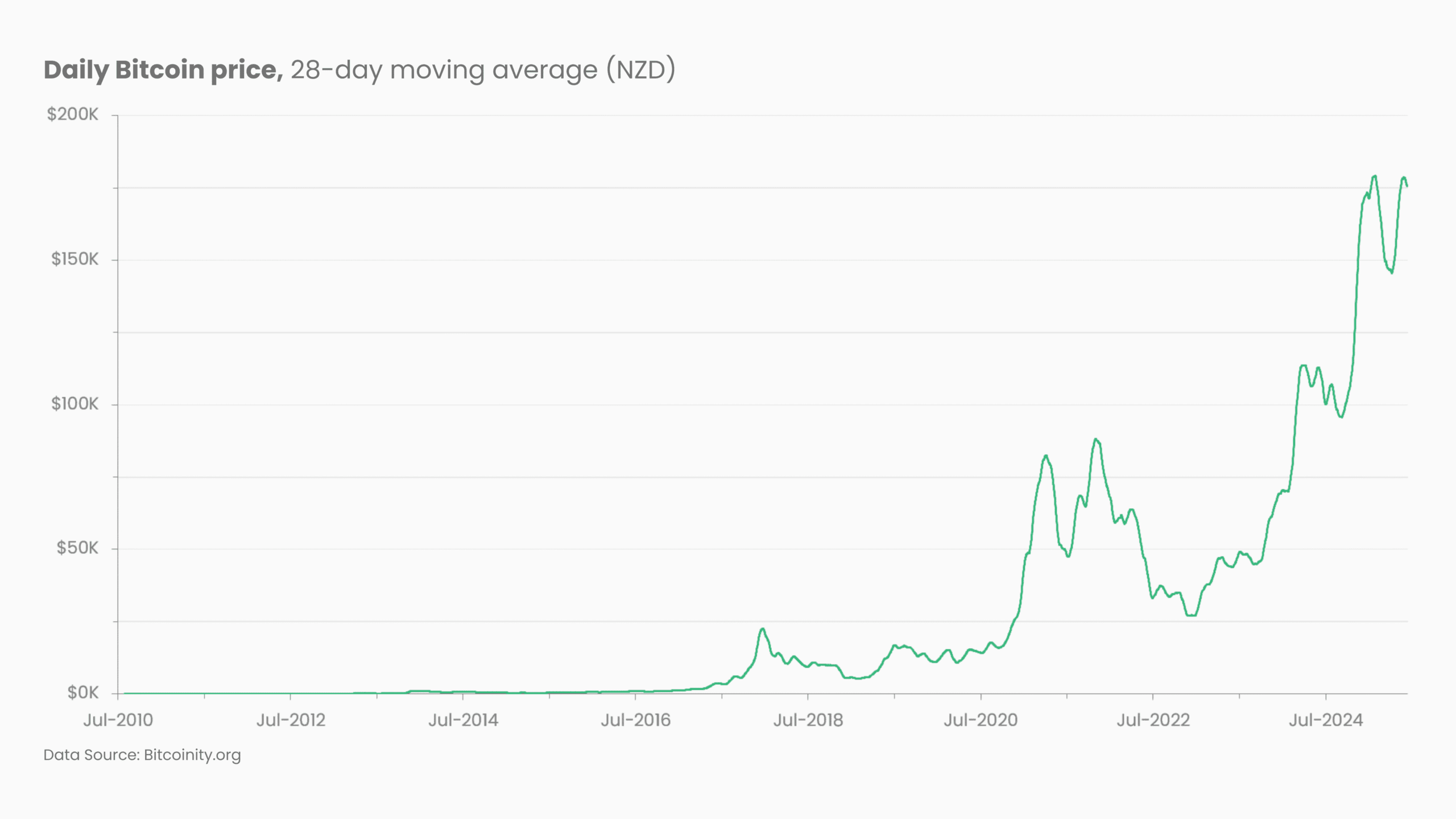

Bitcoin has historically performed well, returning 168% annually since 2010, compared to 12% for the S&P 500 over the same time frame.

Analysing historical returns can give us more confidence that an investment will yield returns, but past performance is not a predictor of future performance.

Before we invest any capital, we need to understand the drivers of Bitcoin’s historical returns and make an assessment on how we think those drivers will act on Bitcoin’s price in the future.

Drivers of Bitcoin’s returns

Regulatory Environment – Historical:

Bitcoin’s price has often reacted sharply to changes in regulation, making the legal environment an important factor in its historical returns.

1. Legality

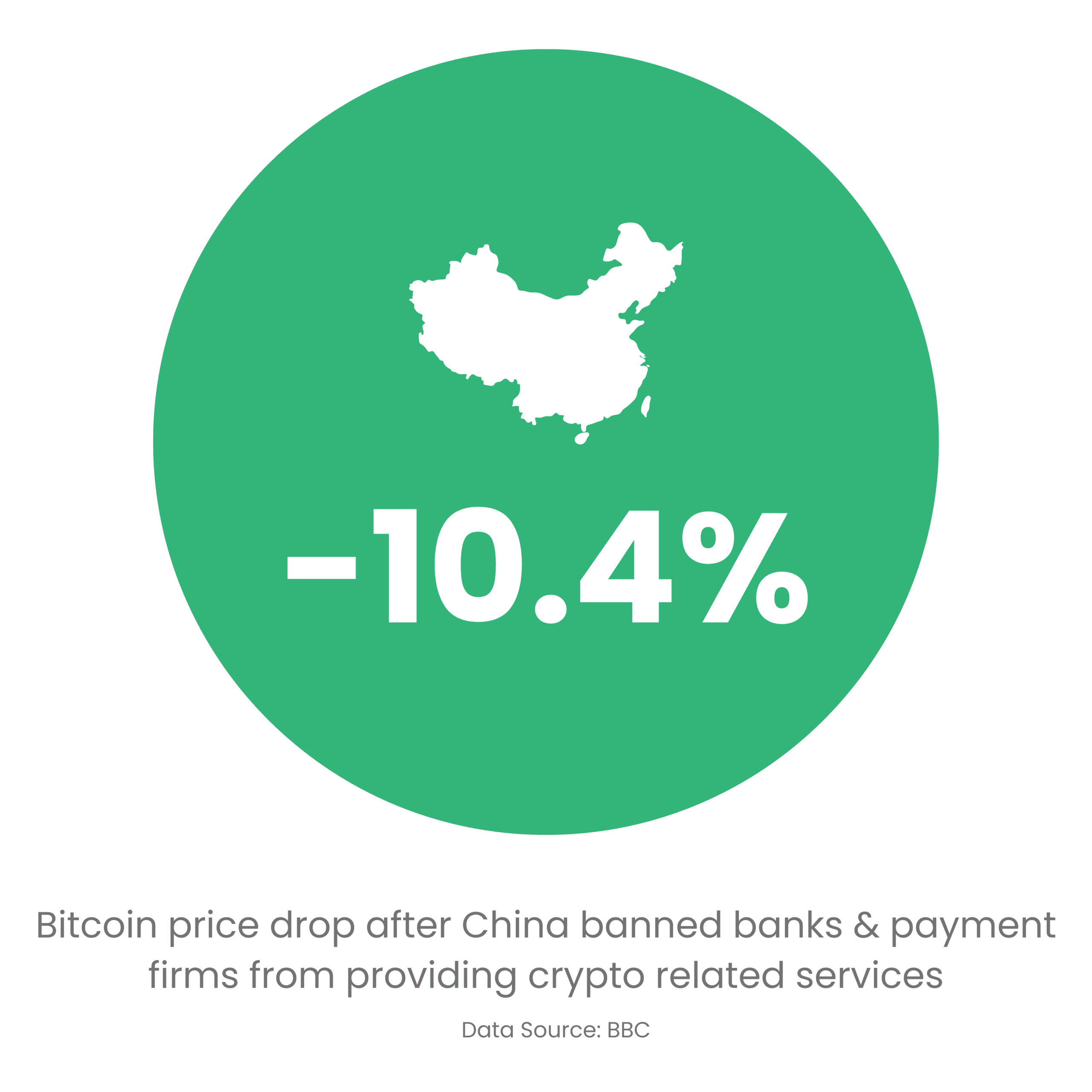

The changing legal status of Bitcoin has historically caused its price to move, sometimes significantly. BBC reported that when China banned banks and payment firms from providing services related to cryptocurrency transactions, the price of Bitcoin fell 10.4%.

2. Tax Classification

The historical tax debate has centred on the classification of Bitcoin as an asset or a currency. Capital gains taxes typically apply to profits on assets, but not on currencies.

The legal distinction between Bitcoin being a currency or an asset may influence investors’ decision to purchase.

Investments that require administrative effort to ensure tax compliance might be less desirable to investors making them less willing to purchase.

3. Bitcoin Financial Products

According to the AFR, US Bitcoin exchange-traded funds (ETFs) have brought in US$54 billion since they debuted in January 2024. While not all of these ETFs hold Bitcoin directly, this still represents a significant inflow of new capital into Bitcoin.

4. Know Your Customer

Know Your Customer (KYC) refers to the identity verification processes that cryptocurrency exchanges and other financial institutions must undertake to reduce money laundering and other illegal activity.

Almost all reputable cryptocurrency exchanges have KYC in place though its existence merely directs bad actors to other purchase and sale methods such as peer-to-peer trading for cash.

Scarcity – Historical

In this regard, Bitcoin shares some similarities with gold, hence its colloquial name – digital gold.

Bitcoin’s scarcity arises from the details behind its technical implementation, limiting the total number of Bitcoin that can ever exist to 21 million.

This differs to traditional fiat currencies whose number in circulation generally increases over time, often reducing the value of a given amount.

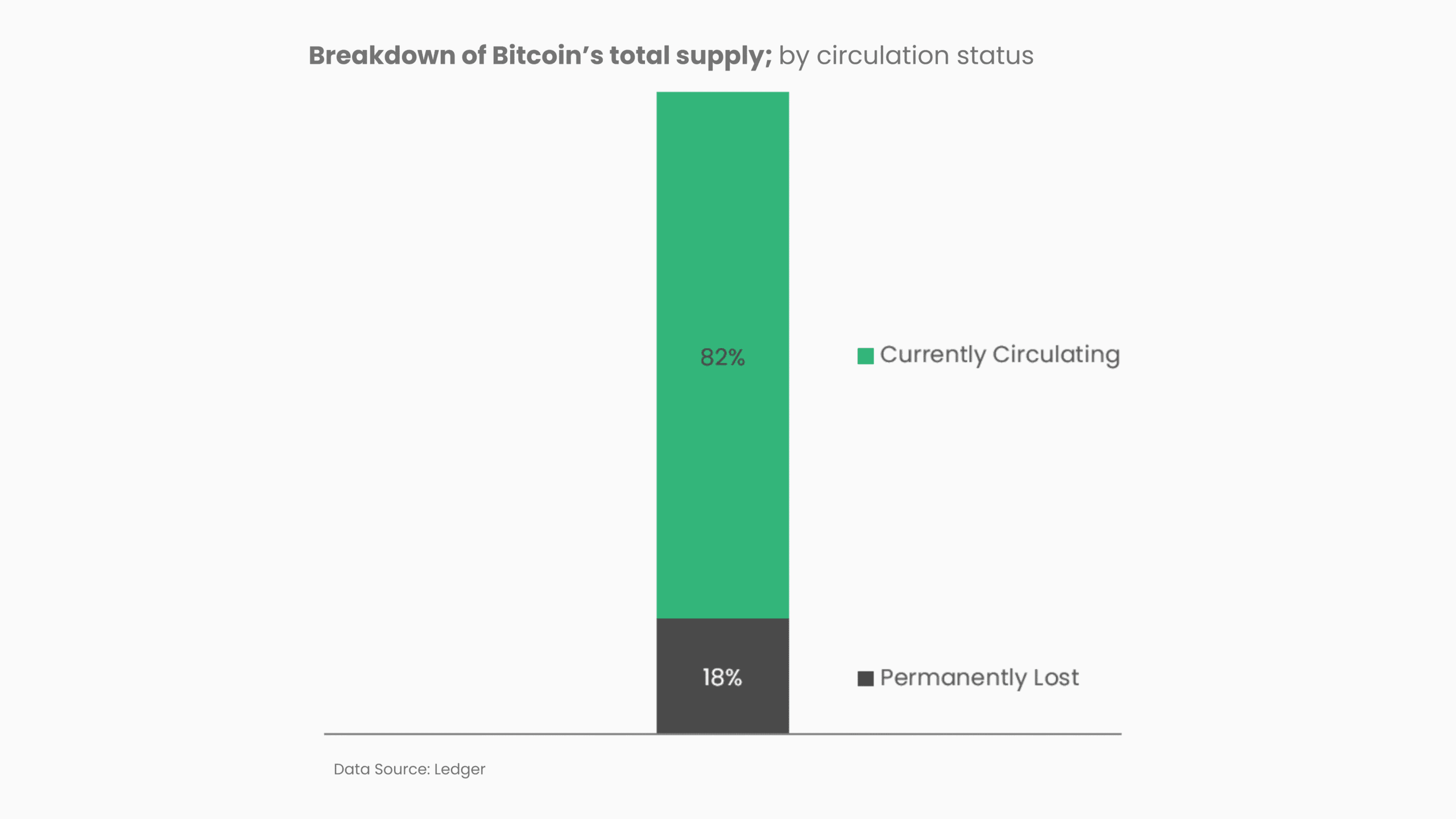

Contributing to scarcity, when private keys are lost, the Bitcoin in those wallets is lost forever. Ledger estimates that up to 3.7 million Bitcoin have already been irreversibly lost, or 18% of the total supply.

Network Effect – Historical

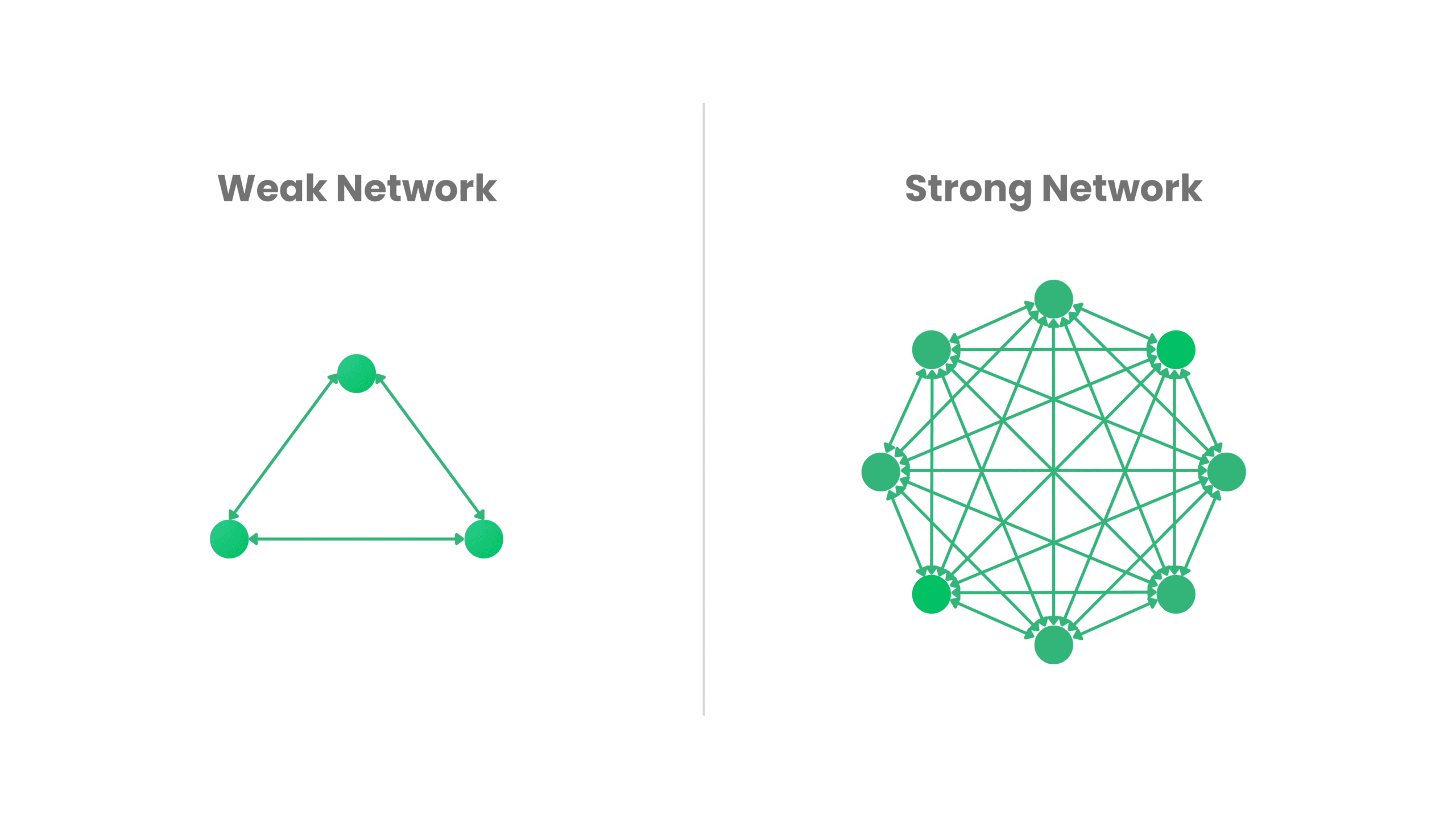

Usable currencies derive value from their widespread use. The more people who accept a currency, the more useful it becomes, creating a positive feedback loop.

Similar real-life examples include online marketplaces such as TradeMe, where more buyers on the platform attracts more sellers.

While a good currency has many qualities, one of the most important is stability. Customers and businesses will be unwilling to transact in a currency that may lose significant value. Given Bitcoin’s historical volatility, its strength as a currency is questionable.

Supporting this argument, just 0.005% of businesses worldwide accept Bitcoin as payment, though this number could grow.

Speculation – Historical:

Speculation has been one of the biggest drivers of Bitcoin’s price. This section explores how different groups of investors; retail investors, institutional investors and even governments have contributed to Bitcoin’s price movements.

1. Retail Investors

Unlike stocks, which represent ownership of companies that produce goods or services, Bitcoin does not generate income or cash flows.

While some investors believe in Bitcoin as the currency of the future, most investors in assets without a productive benefit believe that someone will be willing to buy the asset from you for more than you paid.

A comparable example is Pokémon cards, which have also been speculative investments.

2. Institutional Investors

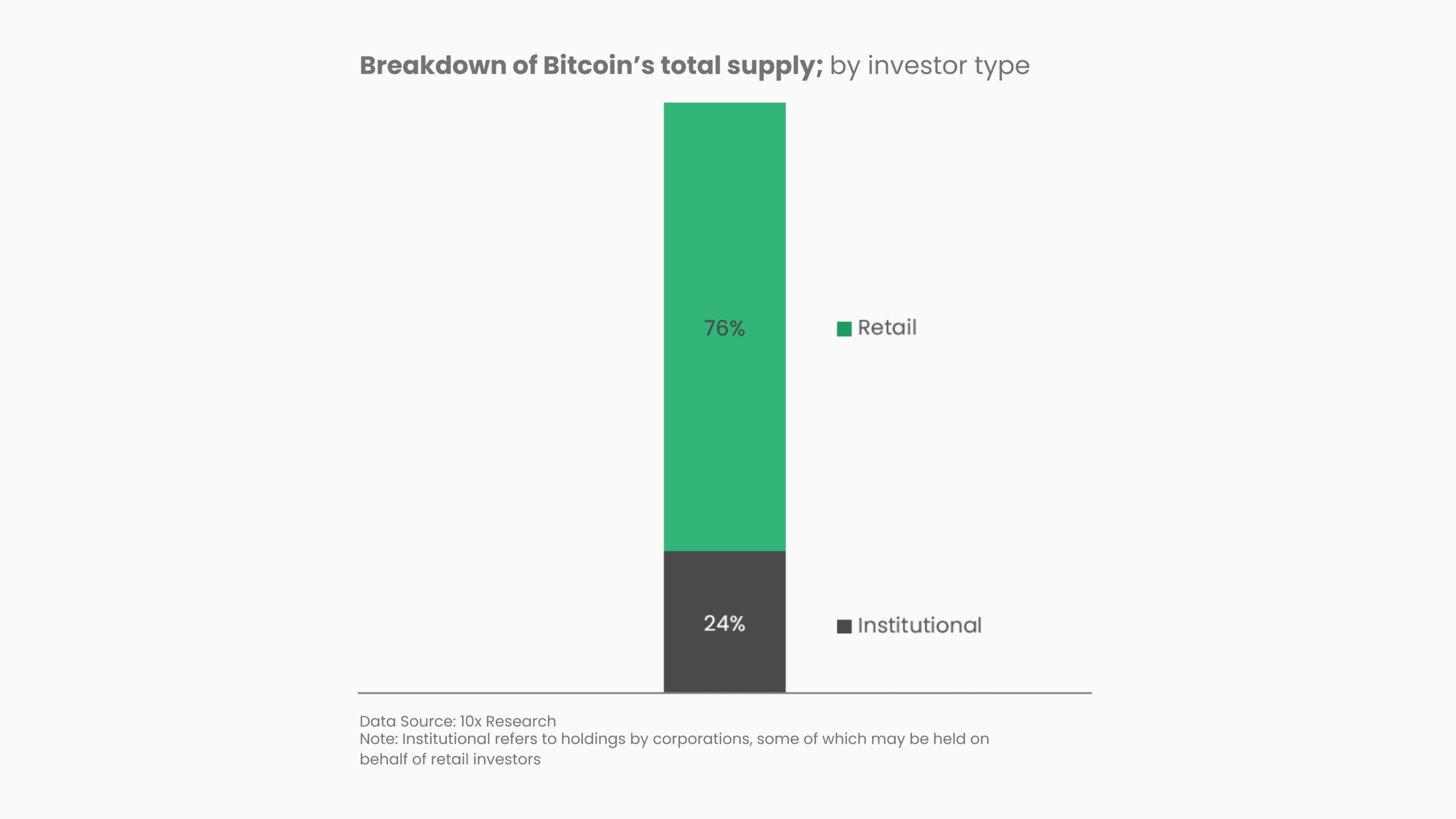

Since the first Bitcoin ETF in 2021, institutional products designed to track the price of Bitcoin have gained traction. 10x Research estimates that roughly a quarter of circulating Bitcoin is now owned by institutional investors.

Just Blackrock’s iShares Bitcoin Trust alone now holds more than 700,000 Bitcoin (though it should be noted a lot of this is held on behalf of retail investors, and these values fluctuate daily).

This reflects the growing legitimacy of Bitcoin as a mainstream investment option.

3. Countries

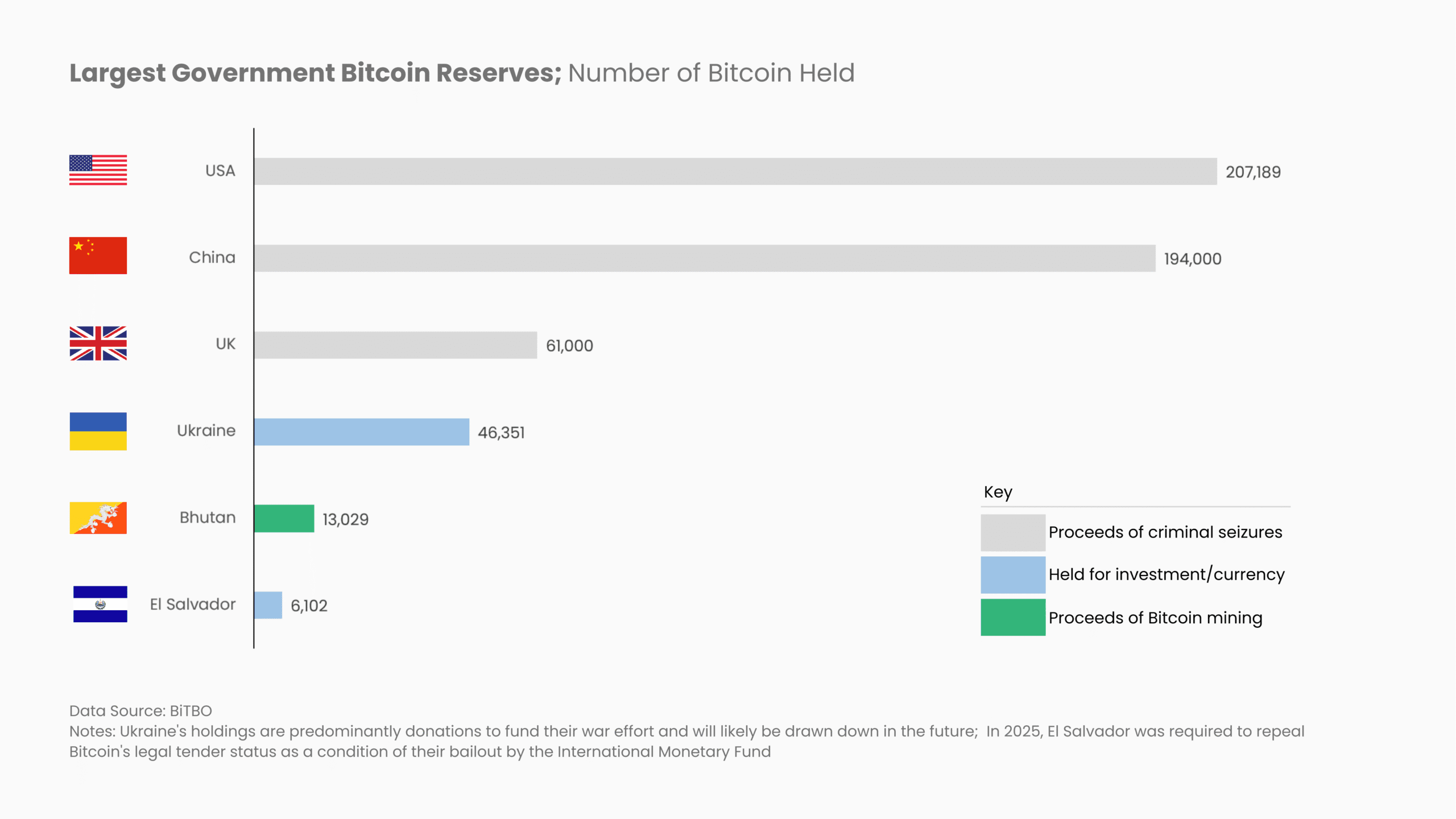

According to BiTBO,governments currently hold ~528,000 Bitcoin, or 2.3% of the total supply. While this is fairly significant, the majority of countries hold Bitcoin because it has been seized as part of law enforcement activities, and doesn’t necessarily mean that governments view Bitcoin as a good investment.

Future Predictions of these drivers

Regulatory Environment – Future:

Bitcoin operates within a global regulatory framework that has matured considerably over the past decade. While early regulatory decisions had the power to dramatically influence Bitcoin’s adoption and price, today the environment is far more stable.

1. Legality

Bitcoin has likely found a stable equilibrium of legality with most countries having determined if Bitcoin is legal or illegal and being unlikely to change this classification.

The legal status of Bitcoin is unlikely to influence Bitcoin’s future returns.

2. Tax Classification

Similar to the relative stability present in the legality of Bitcoin, the tax treatment of Bitcoin is also unlikely to change significantly and so is unlikely to influence Bitcoin’s returns in the future.

3. Know Your Customer

Workarounds to KYC such as peer-to-peer trading will continue to present enforcement challenges, and as such, the implementation of more stringent KYC processes is unlikely to influence future returns of Bitcoin.

4. Bitcoin Financial Products

With most brokerages that allow users to purchase American shares also allowing users to purchase Bitcoin ETFs, it is unlikely that this will be a material driver of Bitcoin’s price in the future.

Scarcity – Future

While Bitcoin’s total supply will continue to increase due to the mining of new Bitcoin, the rate of this increase will slow as the mining reward is halved roughly every 4 years. By ~2140, there will be no new Bitcoin mined and the supply will be capped.

It is unlikely that lost Bitcoin wallets will meaningfully impact Bitcoin’s price, especially given that Bitcoin’s increased value makes owners more protective of their wallets.

As any owner of Beanie Babies will tell you, just because something is rare doesn’t mean it will retain value. Let’s now look at how Bitcoin’s network effect might strengthen and how speculation might influence its future returns.

Network Effect – Future

While Bitcoin’s network effect in payments is certainly weak now, Allied Market Research forecasts that global Bitcoin payments will grow at 16% annually until 2031.

If this forecast is correct, global Bitcoin payments will grow by ~2.5x over current levels. While this reflects material growth, Bitcoin is unlikely to replace fiat currencies anytime soon.

There is also competition from other cryptocurrencies to consider. While there are too many cryptocurrencies to get into specifics, every cryptocurrency has different technology, fees, and maximum transaction volume it can handle.

Bitcoin may lose out to other cryptocurrencies if competing cryptocurrencies become the preferred choice for customers.

Speculation – Future:

That leaves speculation as the most likely driver of Bitcoin’s future returns – the one you’ll need the most confidence in if you’re considering investing. While it is impossible to predict how investors will view Bitcoin in the future, we have some clues.

1. Retail investors

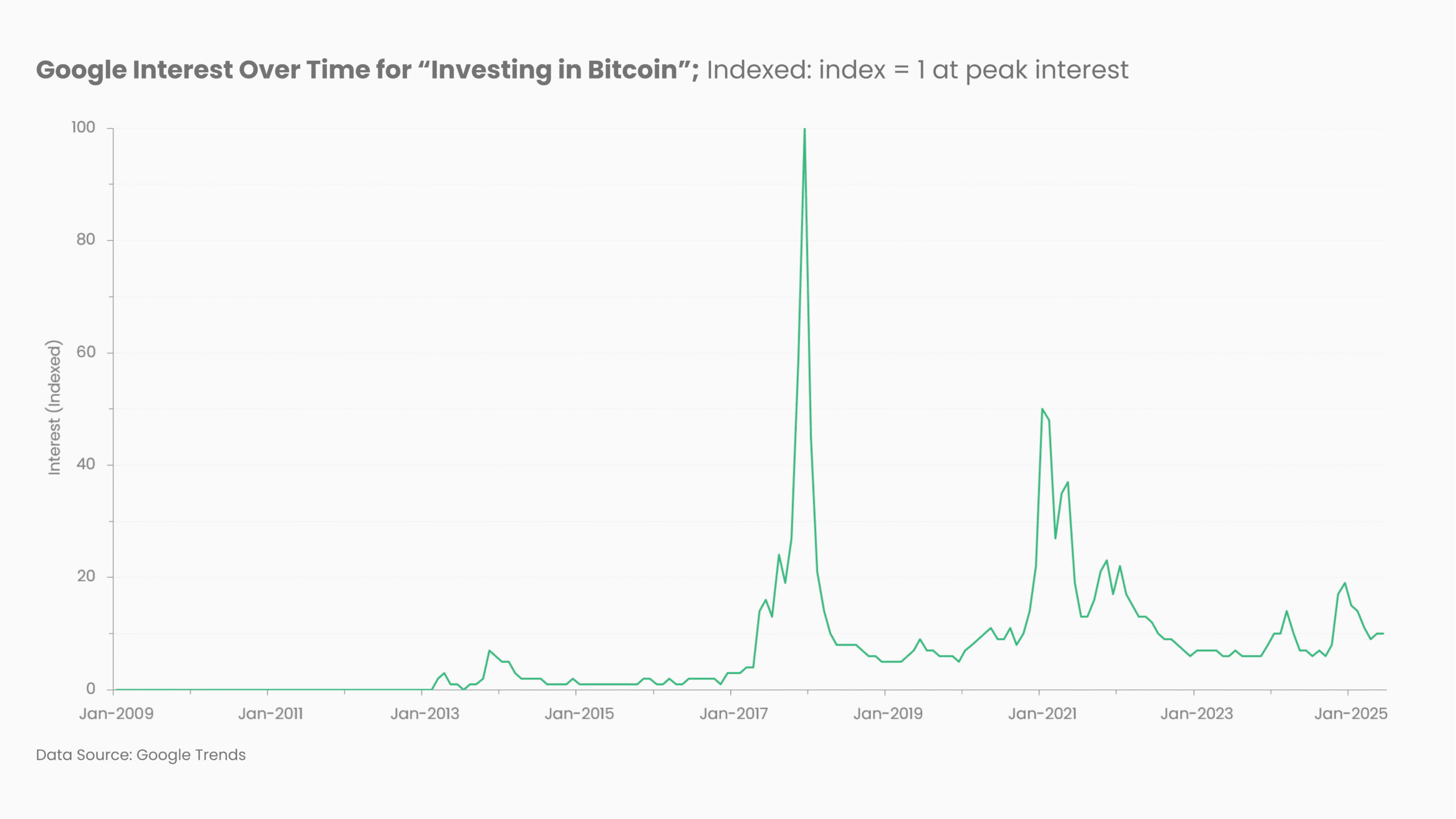

Firstly, we can look at Google search history for Bitcoin to see if interest is generally increasing.

While it does appear to be trending upwards, we can be reasonably sure demand from speculators will wax and wane, and that Bitcoin’s infamous volatility will remain.

Secondly, we can look at investor sentiment surveys to see if more people are looking to invest in Bitcoin or if existing investors are looking to increase their holdings of Bitcoin.

According to a 2025 study, 14% of people without crypto plan to buy it, and 67% of current owners plan to buy even more. This suggests that upside might remain for Bitcoin.

2. Institutional Investors

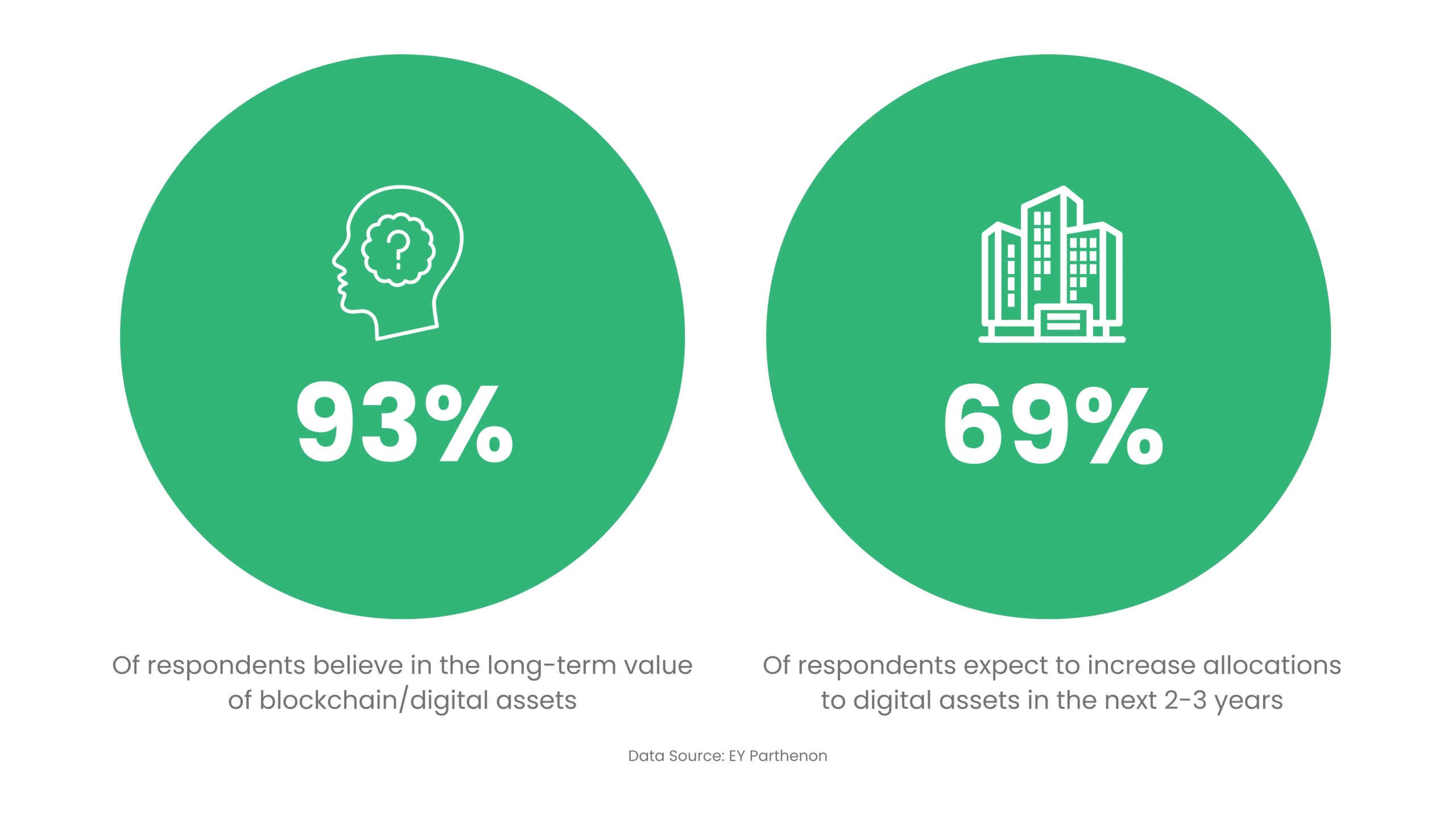

To understand how institutional investors might drive Bitcoin’s price, we can turn to EY’s study on the outlook of institutional investors.

EY reports that 93% of respondents believe in the long-term value of blockchain technology and/or digital assets.

Furthermore, 69% of respondents expect to increase their allocations to digital assets and/or related products in the three years through to 2026.

3. Countries

As part of Trump’s executive order which was signed in March 2025, a Bitcoin strategic reserve will be created and currently held Bitcoin that was forfeited as part of criminal or civil asset forfeiture proceedings will be transferred to this fund.

Bitcoin deposited into this strategic reserve will not be sold, but rather will be maintained as a store of reserve assets. Furthermore, the Secretaries of Treasury and Commerce are authorised to develop budget-neutral strategies for acquiring additional Bitcoin.

The extent to which this is possible is unclear given Trump’s recently passed Big Beautiful Bill. According to the Congressional Budget Office, this bill will increase the United States’ deficit by an expected $3.4 trillion which may make it hard to acquire more Bitcoin in a budget-neutral manner.

It is looking unlikely that sovereign state purchasing of Bitcoin will be a major driver of returns in the future.

El Salvador is arguably the most Bitcoin-forward country globally. In March 2025, it announced the purchase of additional Bitcoin, taking the country’s strategic reserve to 6,102.

In an X post, El Salvadoran president, Nayib Bukele stated the Central American country will continue to purchase one Bitcoin every day until it becomes unaffordable with fiat currencies.

While this sounds impressive, the daily trading volume of Bitcoin is regularly in the 10s of billions of dollars, meaning El Salvador’s purchases will not significantly move Bitcoin’s future price.

Portfolio Allocation

So you’ve decided you want some exposure to Bitcoin, the next question is: what proportion of your portfolio should be allocated to Bitcoin? The following section will break down the factors you need to consider.

Risk Tolerance

A simple rule in finance is the higher your expected return, the higher your risk. In other words, if the chance of you making a lot of money is higher, then the chance of you losing a lot of money is also higher.

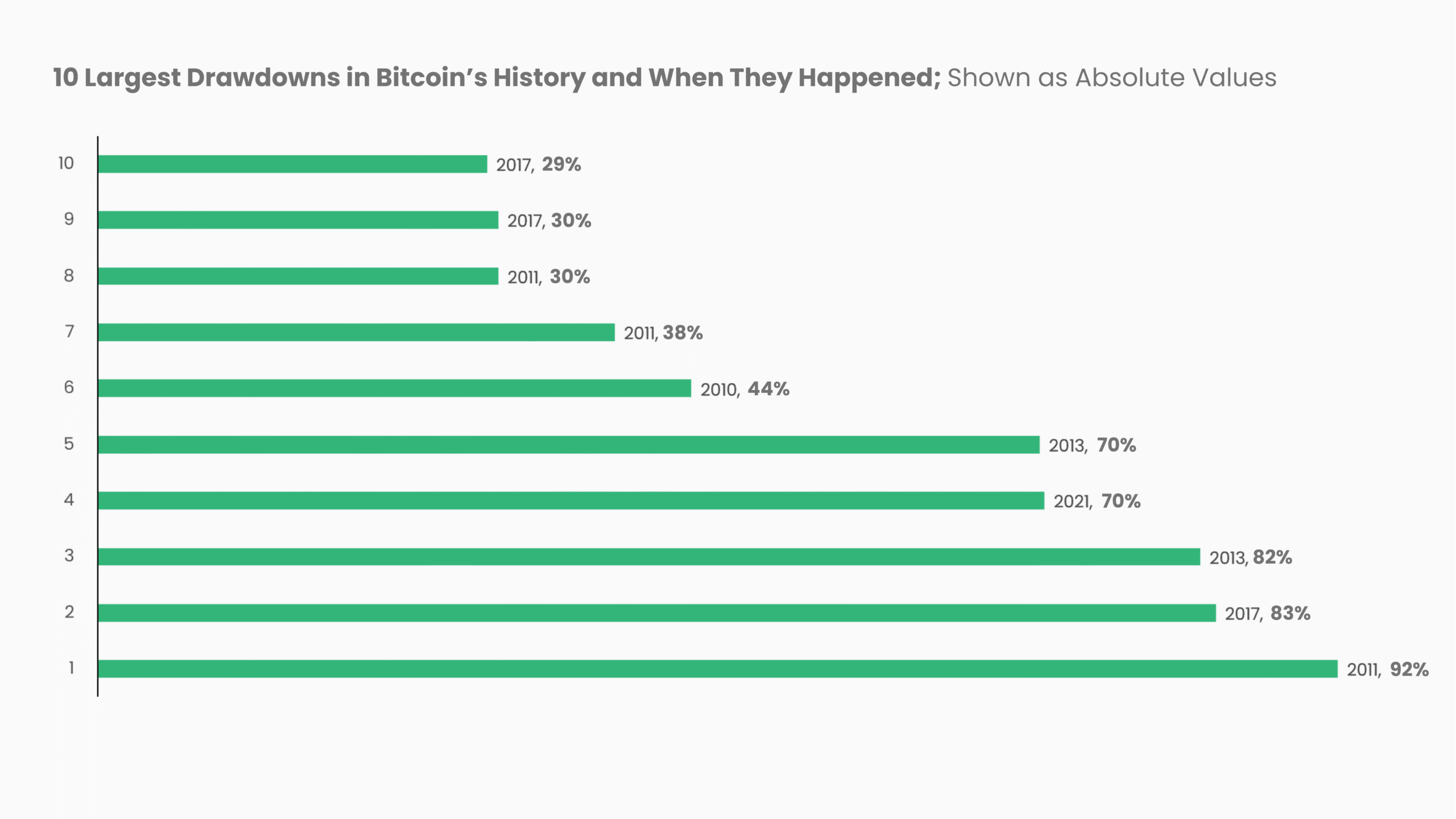

While Bitcoin has experienced great returns since its inception, there have also been periods of very poor returns. Bitcoin’s maximum drawdown (the difference between peak and trough prices) is 92% and 5 separate times it has had a drawdown of 50% or more.

Ask yourself: could you hold through a 50% drop?

There is no wrong answer here, we all have different upbringings, relationships with money and convictions that all inform our unique tolerance for risk.

Time Horizon

Over long periods, markets tend to recover from downturns. A longer investment time horizon is beneficial as it allows for more time to recover from losses.

Investors that are closer to retirement or a big purchase that will require cash, should have a lower risk tolerance as they may not have the time required to recover from market downturns.

Diversification & Correlation

Diversification is the process of lowering risk by adding different and uncorrelated assets to your portfolio.

Uncorrelated simply means that the price movement of one asset does not tend to follow the price movement of another asset. Think of it as ‘insurance’ for your portfolio whereby if one asset drops significantly, the other asset will not.

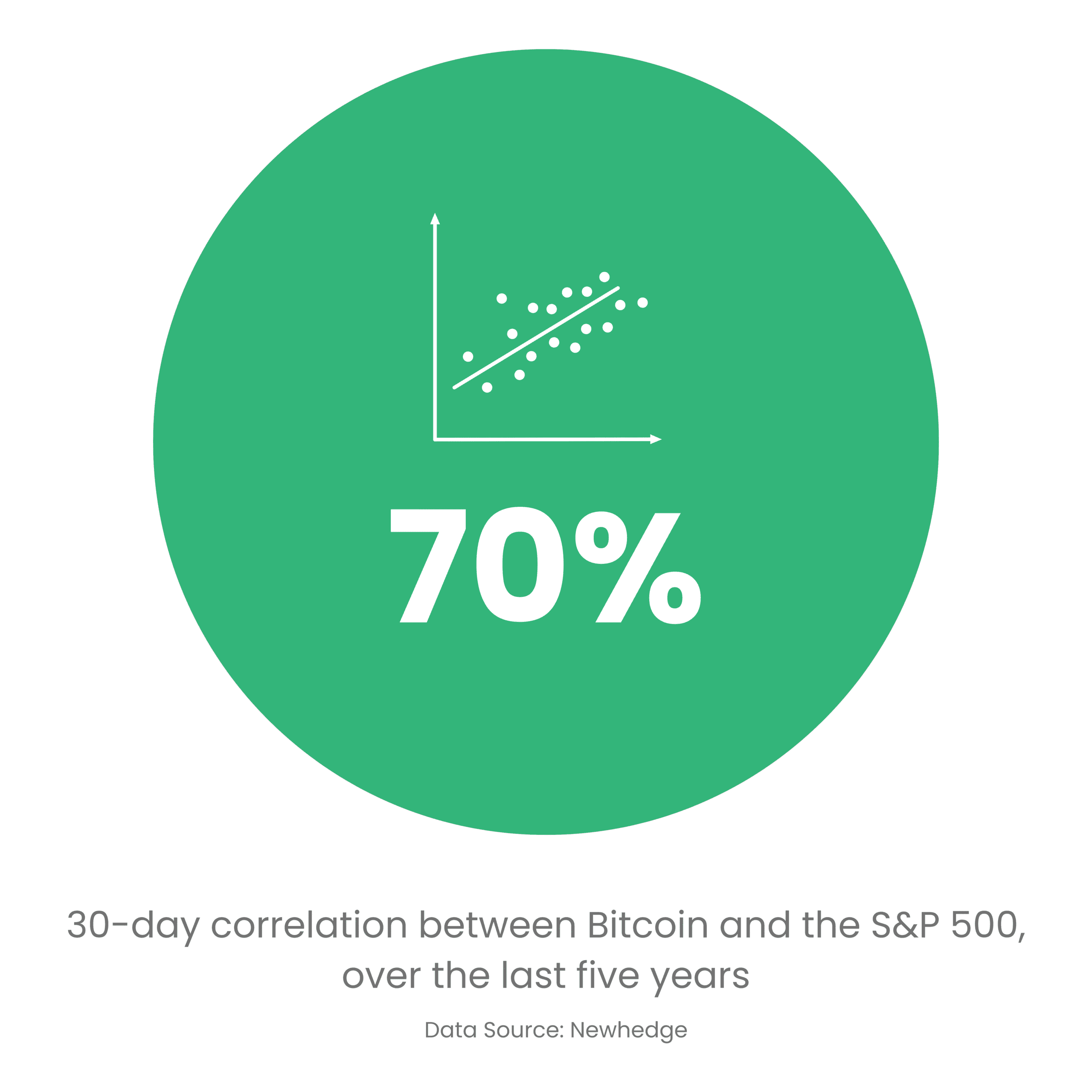

Bitcoin has a strong positive correlation with the stock market. If you already hold US stocks (e.g., via KiwiSaver), Bitcoin may not provide much diversification.

Conclusion

With scarcity and Bitcoin’s network effect as a currency being unlikely to materially drive its future returns, investors should be confident that other investors will continue to speculate on Bitcoin’s future growth.

Strong conviction is a prerequisite for investment as it is almost inevitable that Bitcoin’s infamous volatility will persist.

If you have decided that Bitcoin is the right investment for you, head over to our How to Buy Bitcoin in New Zealand page to see how you can purchase your first Bitcoin.

If you don’t feel comfortable managing your own crypto wallet, read about other ways to get exposure to Bitcoin without buying it.

Disclaimer

The information provided on this website is for informational and educational purposes only and should not be considered financial, or any other, professional advice. We do not provide personalised investment advice, financial recommendations, or endorsements of any particular financial products or strategies.

You should conduct your own research and consult a qualified financial advisor before making any financial decisions. The authors of this website do not assume any responsibility for external website content or how the information on this website is used.