Whether you’re thinking about buying your first crypto or already own some, understanding how crypto wallets work and how to use them safely is one of the most important steps.

In this guide, we’ll break down what wallets do, how to use them, and how to figure out which type is right for you.

We’ve also included a few security tips and a list of wallets we personally recommend.

New to crypto entirely? Check out our Blockchain & Crypto Beginner’s Guide.

What Is a Crypto Wallet?

One of the most common misunderstandings around crypto wallets is that they store your coins.

Your coins are actually nothing more than a public record on the blockchain. A wallet simply stores the key that allows you to access and spend these coins.

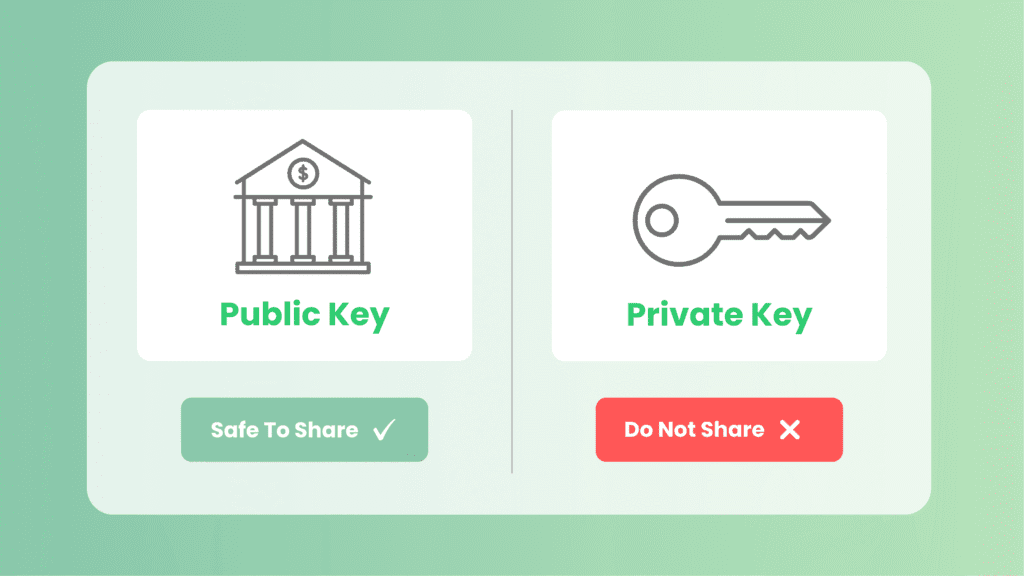

When you first set up a wallet, it generates a pair of public and private keys.

The public key creates your wallet address. This is the address you use to receive crypto, similar to a bank account number.

The private key is what your wallet stores securely. It is used to prove that you own your crypto and allows you to spend it. Anyone with access to your private key has full control over your funds.

Here’s a simple way to think about it:

- Your wallet address is like your bank account number (safe to share)

- Your private key is like your PIN or password (keep it secret)

Any time you send crypto from your wallet, it signs the transaction using your private key to prove it’s you making the transaction. This transaction is then broadcast to the public blockchain where it is verified.

Having a basic understanding of how crypto wallets work and the role of public and private keys will help in understanding which type of wallet is best suited to you.

Types of Crypto Wallets

Not all wallets are the same. Some wallets are built for maximum security, while others are designed for convenience and usability. The right type of wallet for you depends on a few individual factors, such as how much crypto you own and how you plan to use it.

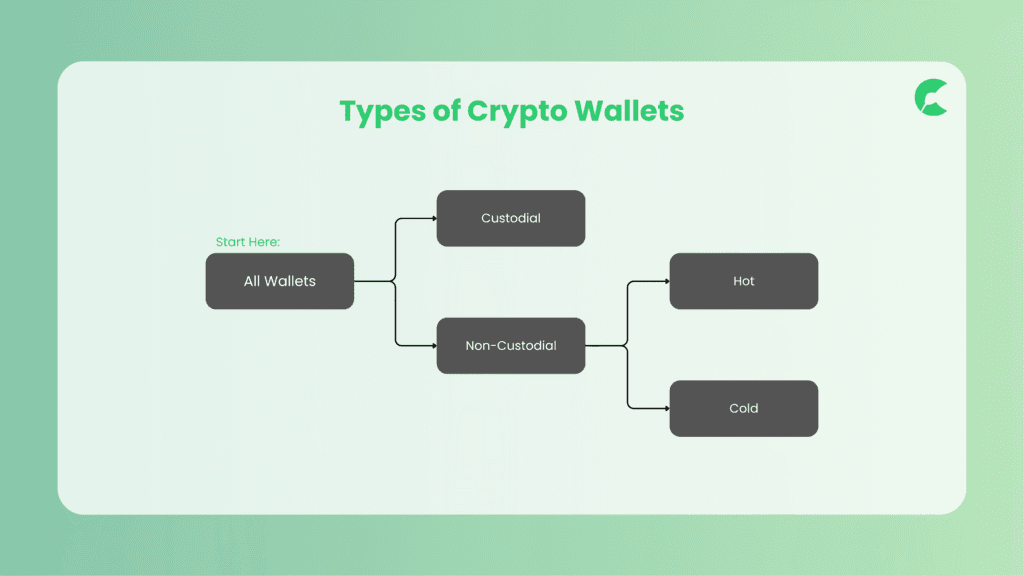

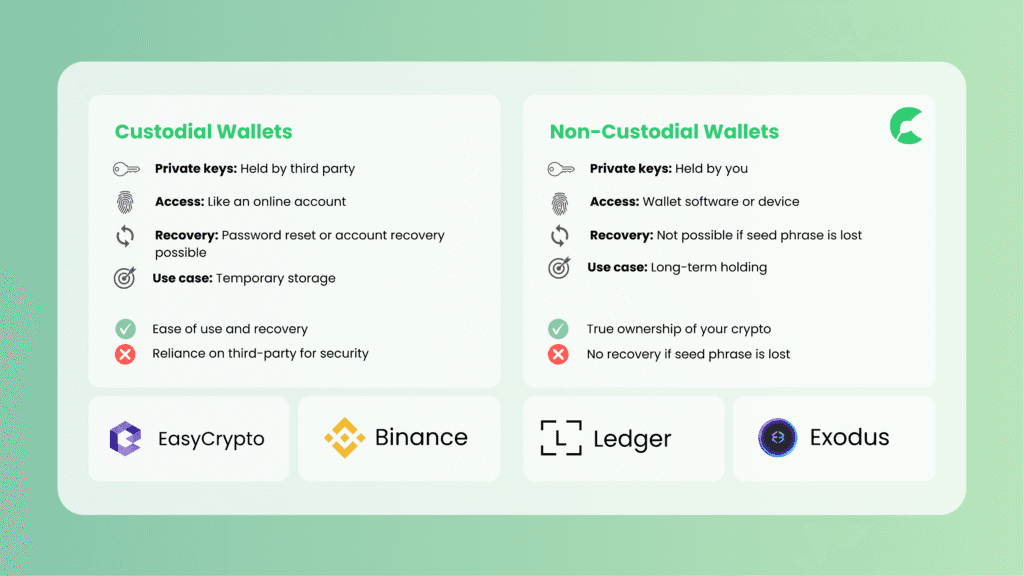

Custodial vs. Non-Custodial

At the top level crypto wallets can be separated into two categories – custodial and non-custodial wallets. This differentiation comes down to one of the fundamental ideas behind Bitcoin and crypto: self-custody and control.

Crypto is often praised for the fact that you are in full control of your funds rather than trusting a bank or exchange to hold it for you. However, this only applies if you hold your own private keys.

Crypto wallets are traditionally non-custodial, meaning you control and store your own private keys. You have full ownership and control of your crypto without needing a third party.

Today, it is easier than ever to buy crypto. Many exchanges, apps, and brokers allow you to buy crypto in a similar way to stocks, where these third parties hold your assets on your behalf.

This is what we refer to as a custodial wallet: a third-party manages your private keys and is in full control of your crypto. You simply have access to your account with this third-party but not the keys themselves.

Similar to your other accounts, like your email or internet banking, a lost password does not generally lock you out of the account permanently. Most custodial wallet providers offer options for account recovery.

This makes custodial wallets very beginner-friendly and easy to use.

A common phrase you’ll hear in the crypto-space is:

Not your keys, not your coins.

Many believe that if you are not in control of the private keys, you do not truly own your crypto. We recommend storing your crypto in a non-custodial wallet when holding for the long term.

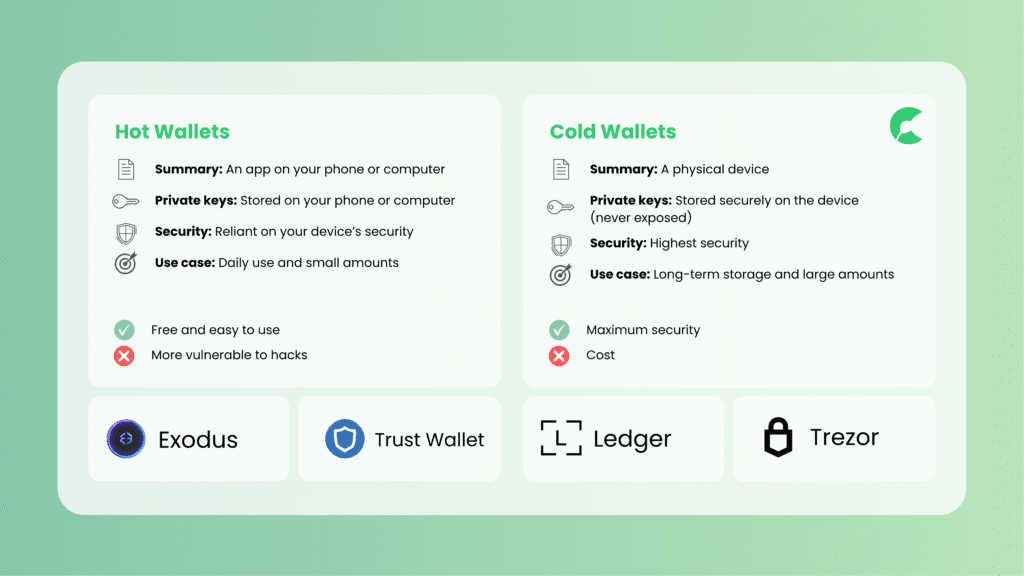

Hot Wallets

Hot wallets, also known as software wallets, are available for your phone or computer (including browser extensions) and store your private keys locally on your device. They’re free and great for convenience while maintaining full control over your crypto.

Hot wallets do, however, rely on the security of your device. A malware- infected computer could result in the theft of your private keys and therefore your crypto.

Cold Wallets

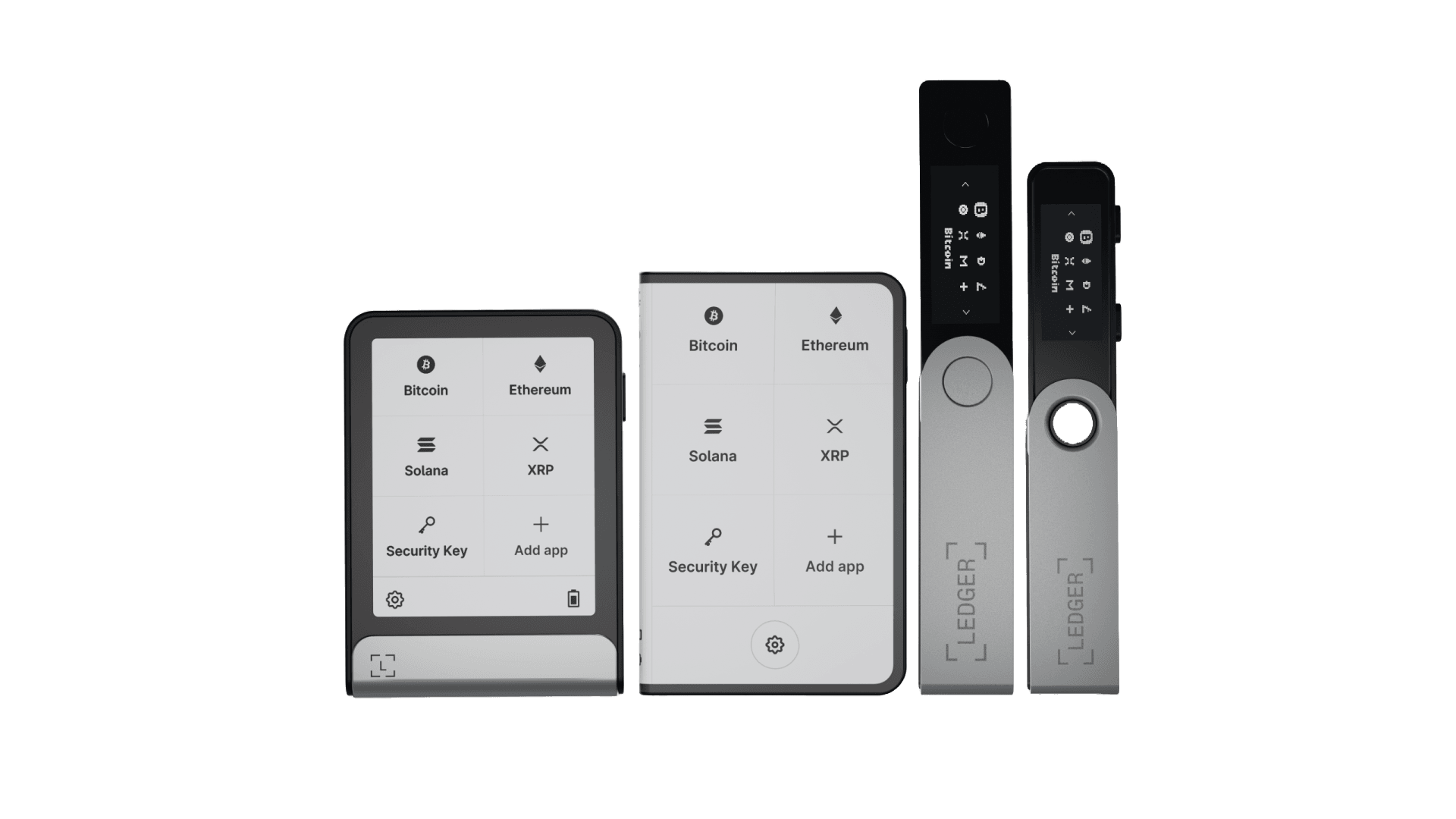

Cold wallets, also known as hardware wallets, are physical devices that store your private keys offline within the device.

To access your crypto and approve transactions, the wallet is connected to your computer via USB cable or to your phone via Bluetooth. You then initiate transactions on your phone or computer which are signed using the private keys directly on your hardware wallet.

Cold wallets are the most secure option because they ensure your private keys are never exposed anywhere. They are designed so that the private keys never leave the hardware wallet, even when connecting to your computer.

Paper wallets are another type of cold wallet. They are simply pieces of paper with your private key and wallet address printed on them, often as QR codes.

While they are considered cold wallets and are completely offline, they still require generating a private key on a device before printing.

Paper wallets can be secure if created and stored carefully, but they are generally considered outdated and risky for beginners.

How To Choose a Wallet

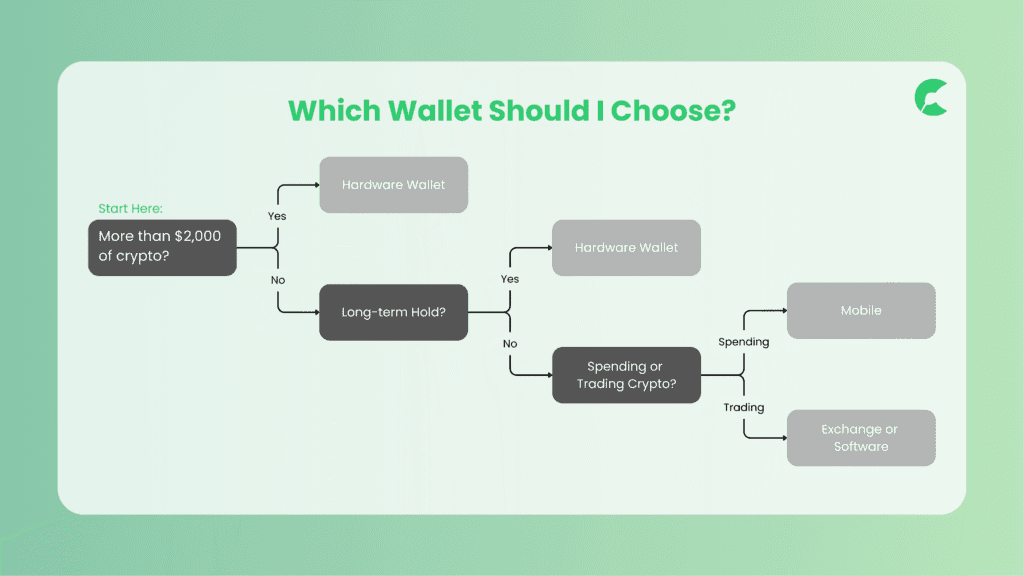

Deciding which wallet is right for you comes down to the following factors:

- The value of your holdings

- The time you intend to hold your crypto for

- The purpose of owning crypto (e.g. long-term investing or spending)

Firstly, we recommend a hardware wallet to anyone who has significant holdings or is planning to hold their crypto long-term.

The definition of what is significant or long-term depends on your individual circumstances. As a general guideline, holdings of more than $2,000 or a holding period of more than a few months warrant the purchase of a hardware wallet.

Secondly, your use case helps to determine the best type of wallet.

If you’re planning to spend your crypto by paying people or using it in stores, a mobile wallet is the most convenient option. This allows you to quickly access your crypto on the go and scan payment QR codes in stores.

For anyone frequently trading crypto, a software wallet or even a custodial wallet is likely the best option. A custodial wallet, storing your crypto on an exchange, is best when trading multiple times per day. For less frequent trades, a software wallet is more appropriate.

When choosing a wallet, there is always a tradeoff between cost, convenience, and security. Ultimately, this comes down to personal preference but a hardware wallet should always be the preferred option.

Our Recommendations

Hardware Wallets

Trezor

A trusted, open-source wallet that prioritises transparency and security.

Software Wallets

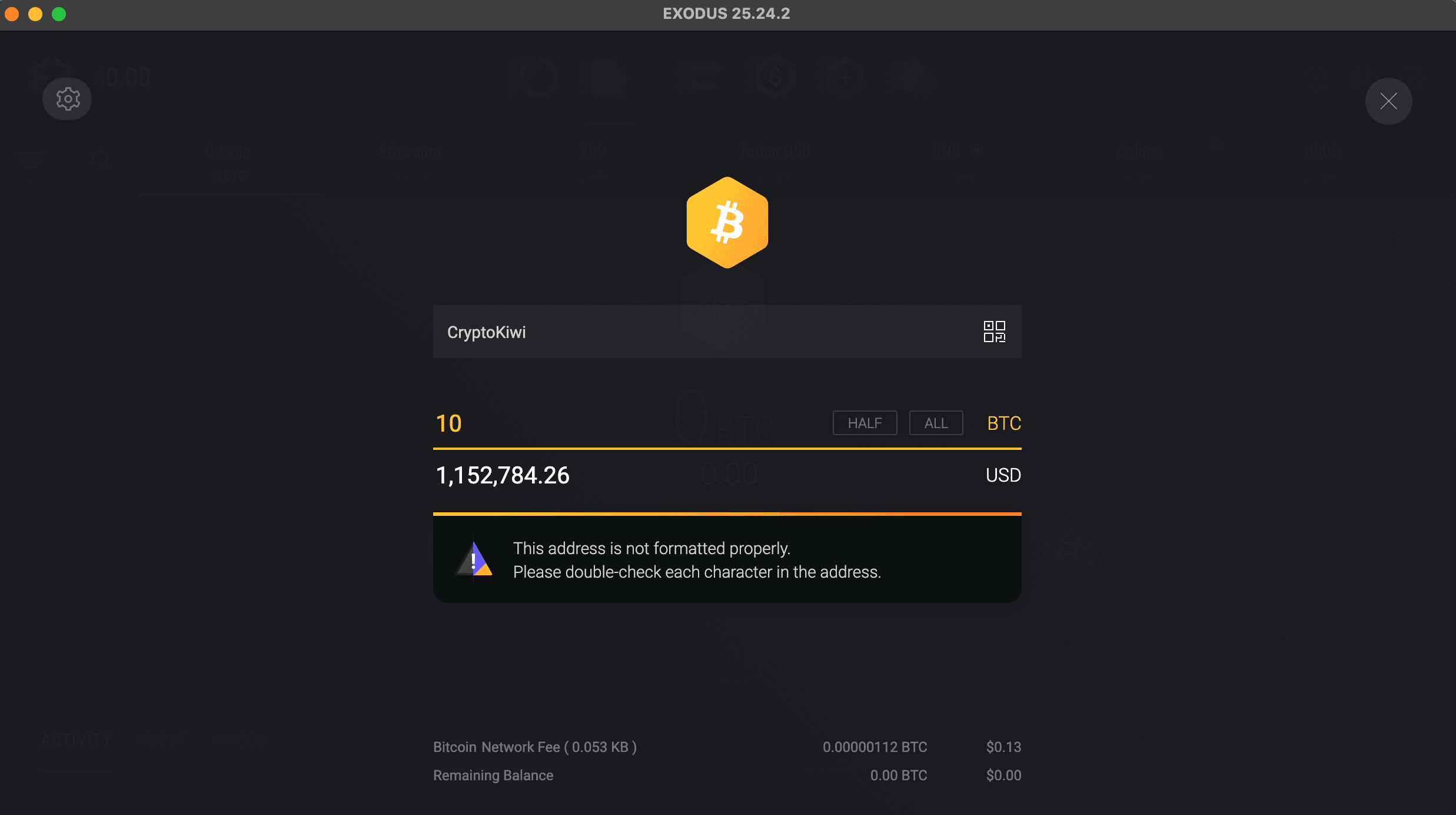

Exodus

A polished and beginner-friendly wallet with an intuitive interface and built-in portfolio tools.

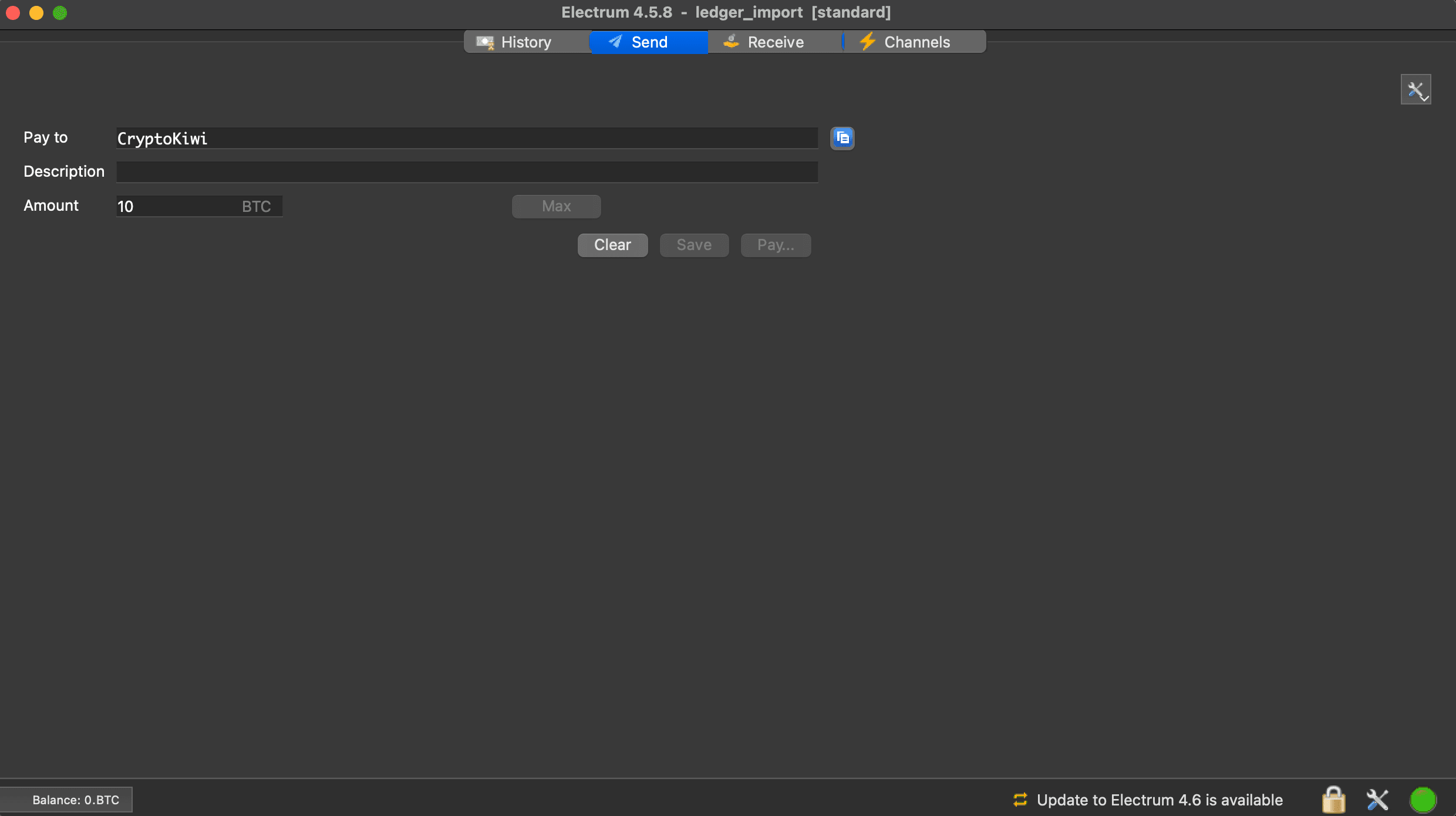

Electrum

A fast, no-frills Bitcoin wallet trusted for its security, flexibility, and advanced features.

Mobile Wallets

Exodus

A well designed mobile wallet that’s beginner-friendly, with built-in portfolio tracking.

Trust

A secure mobile wallet backed by Binance, ideal for safely storing and managing a wide range of crypto.

Security Tips

Backups & Seed Phrases

- A seed phrase or recovery phrase is a list of 12 or 24 words that is generated when you first set up a wallet.

- This phrase is used to access and recover your funds in the case that you lose the device.

- Never store your seed phrase online. Instead, write it down on paper or engrave it in metal.

- Keep multiple copies in a number of different locations (e.g., your house and a bank vault).

Avoiding Scams & Phishing

- Always double-check web addresses.

- Only download and buy wallets from trusted sources.

- Be wary of any emails relating to crypto and don’t click any links. Access crypto websites only directly via their URL.

Device Security

- Keep wallet apps, operating systems, and firmware up to date.

- Only install wallets from trusted sources.

- Use antivirus or anti-malware tools on your devices.

- Avoid public Wi-Fi for transactions.

Account Security

- Access crypto websites only directly via their URL.

- Use strong passwords.

- Use two-factor authentication (2FA) whenever it’s available.

Next Steps

Now that you know how wallets work, the different types available, and how to keep your crypto safe, you’re in a strong position to take the next step.

If you’re ready to get started, check out our step-by-step guide on how to buy crypto in New Zealand. It covers everything needed to make your first purchase and safely store your crypto.

If you’re not quite sure whether Bitcoin is the right investment for you, check out our Should I Buy Bitcoin article.

If you don’t feel comfortable managing your own crypto wallet, read about other ways to get exposure to Bitcoin without buying it.