You might have heard about Bitcoin’s exceptional returns since its launch in 2009, or maybe you’ve heard about Microsoft using blockchain technology to improve traceability in supply chains.

This beginner-friendly guide will strip away all the hype and give you a clear explanation of blockchains, crypto and everything else you need to know to get up to speed.

What is Blockchain Technology

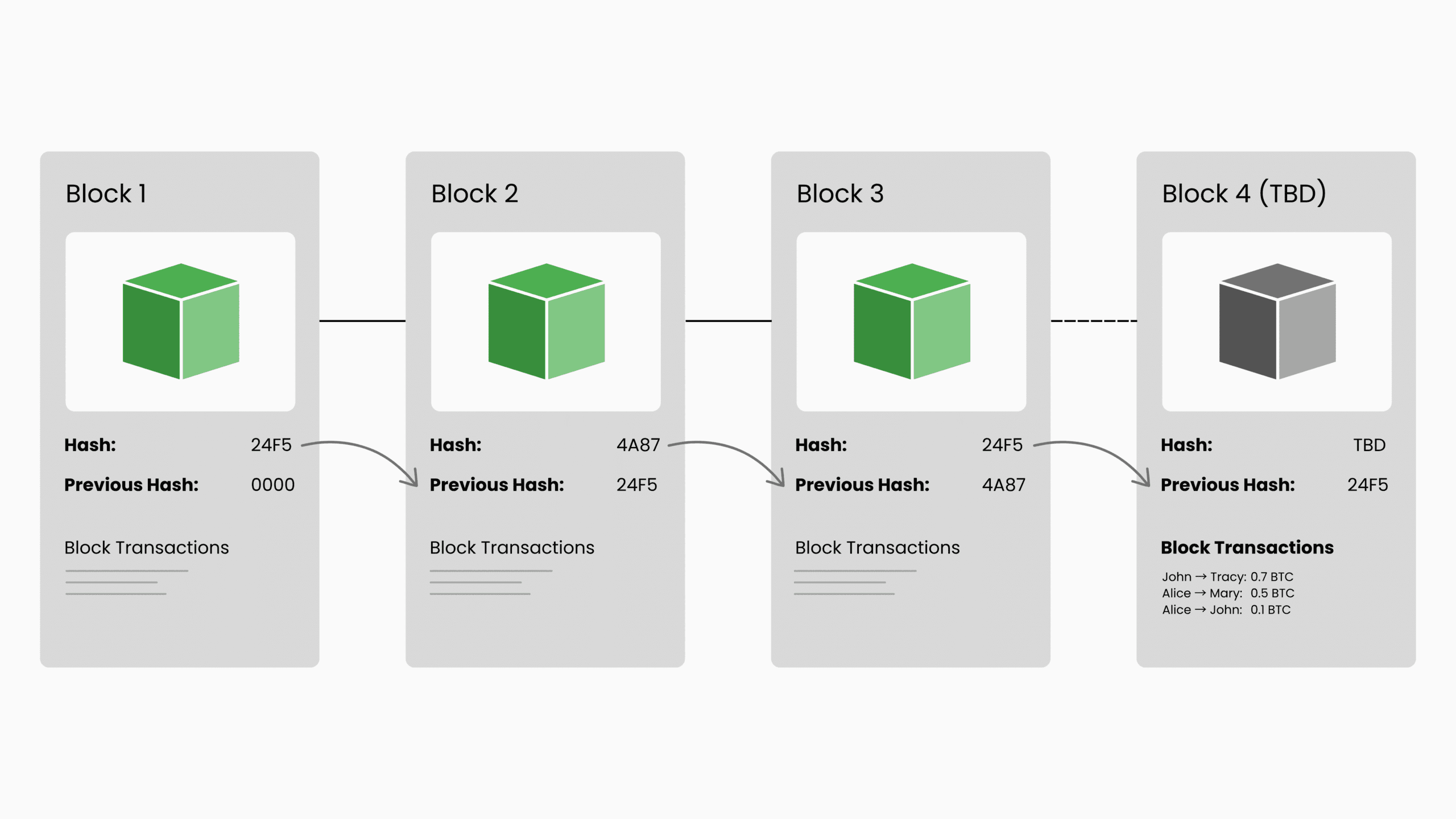

Blockchain is fundamentally a record-keeping system designed to promote trust and transparency.

It is quite literally a chain of blocks (made up of a set of transactions) that are linked together by cryptographic hashes (fancy maths used in code-breaking and other cybersecurity domains) to ensure a trustworthy history of transactions.

Together, these blocks form a publicly accessible digital record book of all transactions that occurred.

This technology is what allows for decentralised crypto like Bitcoin. It provides a way for many users to transact without a centralised authority like a bank to determine the legitimacy of transactions. Instead, thousands of users use personal computing power to verify transactions in a process known as “mining”.

The blockchain is a public ledger that anyone can view. Every transaction, wallet address, and balance is visible to everyone, though only the wallet owner can control or spend the funds. This transparency is a core feature of most cryptos.

The existence of the cryptographic hashes connecting each block ensures that any fraudulent attempt to add a new block to the blockchain can be rejected.

While most recognisable in the context of crypto, which we will explore in the next section, blockchain technology can be used anywhere a tamper-proof record-keeping system is needed, and there is no suitable centralised authority to manage it.

What Is Crypto

A crypto is simply a digital alternative to a traditional currency such as the New Zealand Dollar.

While traditional currencies are generally managed by reserve banks like the Reserve Bank of New Zealand, and transactions are generally authenticated by retail banks such as Westpac, there is no direct equivalent to either of these parties for digital currencies.

For this reason, most crypto use blockchain technology to replicate the role that retail banks play in authenticating transactions. The blockchain allows for tamper-proof recording of all transactions and prevents the creation of fraudulent transactions.

Cryptocurrencies position themselves as a way to spend money without the oversight of the government or centralised retail banks like Westpac. This has both pros and cons, which we will discuss next.

What Is a Crypto Wallet?

One of the most common misunderstandings is that crypto wallets store your coins. Instead, your wallet stores your private keys, which prove that you own your coins.

When you first set up a wallet, it generates a public key and a private key.

The public key creates your wallet address which is used to receive your crypto. This is equivalent to your bank account number, and is safe to share.

Your private key is used to prove ownership of your crypto, and allows you to spend it. Anyone with access to your private key has full control of your funds. It is equivalent to the password to your bank account, and is not safe to share.

For more information on the types of wallets and their pros and cons, check out our Beginner’s guide to Crypto Wallets.

Pros and Cons of Crypto

Pros

- Control: Crypto lets you fully control your funds. Banks cannot freeze your account or reverse transactions.

- Trustless: While unlikely, a centralised power such as a bank may be hacked, and fraudulent transactions created to steal your money. This is not possible with crypto.

- Global: Crypto can be accepted anywhere in the world, there is no need to worry about foreign exchange fees or banks charging high fees for overseas transactions.

- Privacy: Personal details are not shared when spending crypto like they are with card payments.

- Transparency: All transactions are recorded on a public ledger, making it easy to audit and track activity.

Cons

- Complexity: While traditional banking is as simple as making a username and password with your bank, crypto requires managing a private key and recovery phrase, without which your crypto will be permanently lost.

- Accessibility: The benefit of a centralised authority is that there is a third-party that can offer assistance if you need it. If you have ever reset your bank password after forgetting it, you have benefitted from a centralised authority. These benefits don’t exist with crypto.

- Stability: A stable and well managed currency is critical for the success of any economy. Central banks maintain a stable financial system and currency. There is no equivalent for most crypto, making them more volatile and generally less suited to large-scale commerce.

- Acceptance: Only a very small proportion of businesses accept payment in crypto.

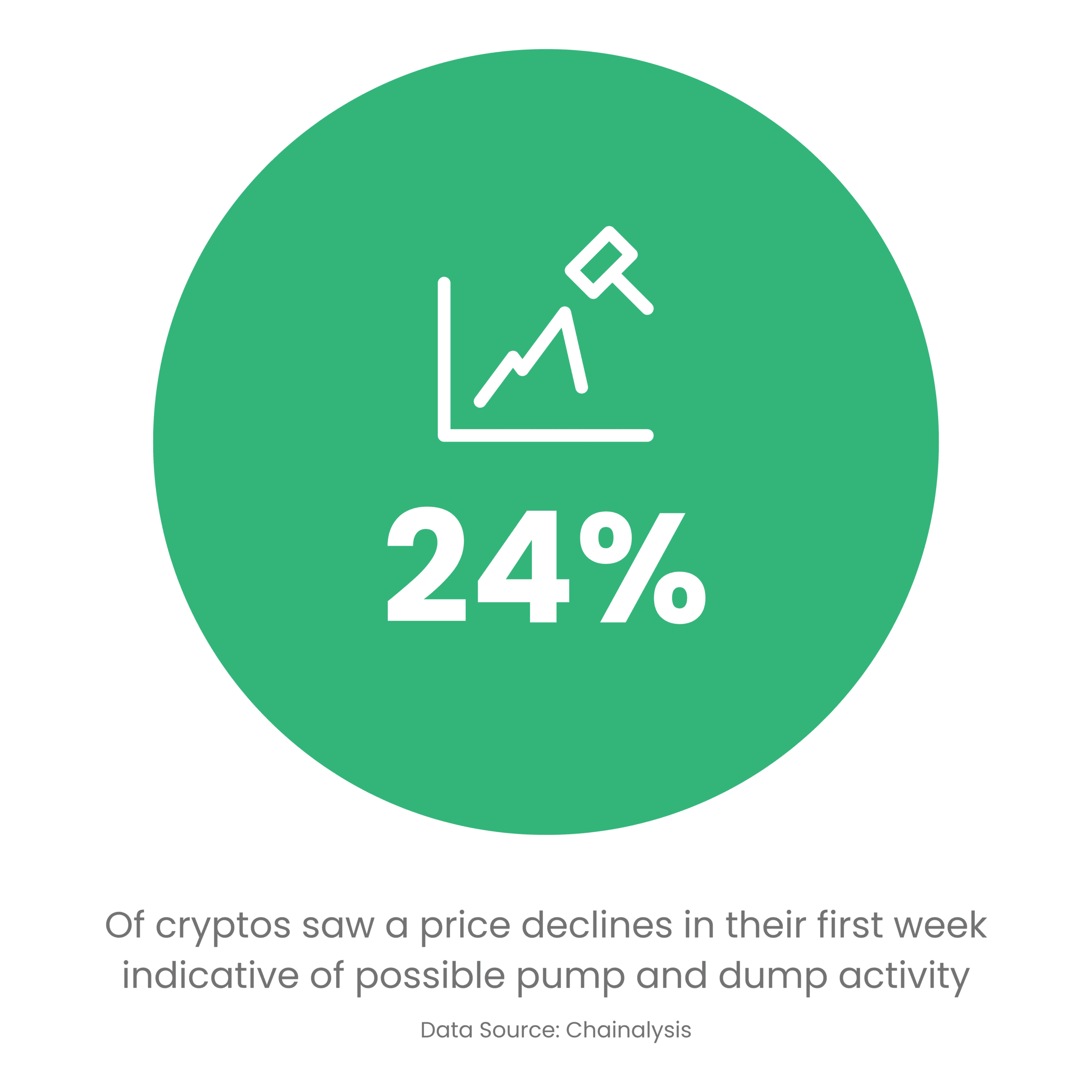

- Scams & Fraud: Most governments have designated agencies to prevent fraudulent currencies. In New Zealand, the Serious Fraud Office is assigned this responsibility. There is no such equivalent for crypto, making fraud a very serious problem in the crypto space. Chainalysis reports that 9,902 crypto, or 24% of those that gained sufficient traction to be worth analysing, saw a price decline in the first week of trading indicative of possible pump and dump activity.

Types of Crypto

While there are 10s of thousands of different cryptos, many without any significant trading volume, they fall into one of four different types. This section will explore how Bitcoin compares to each of these types of currencies.

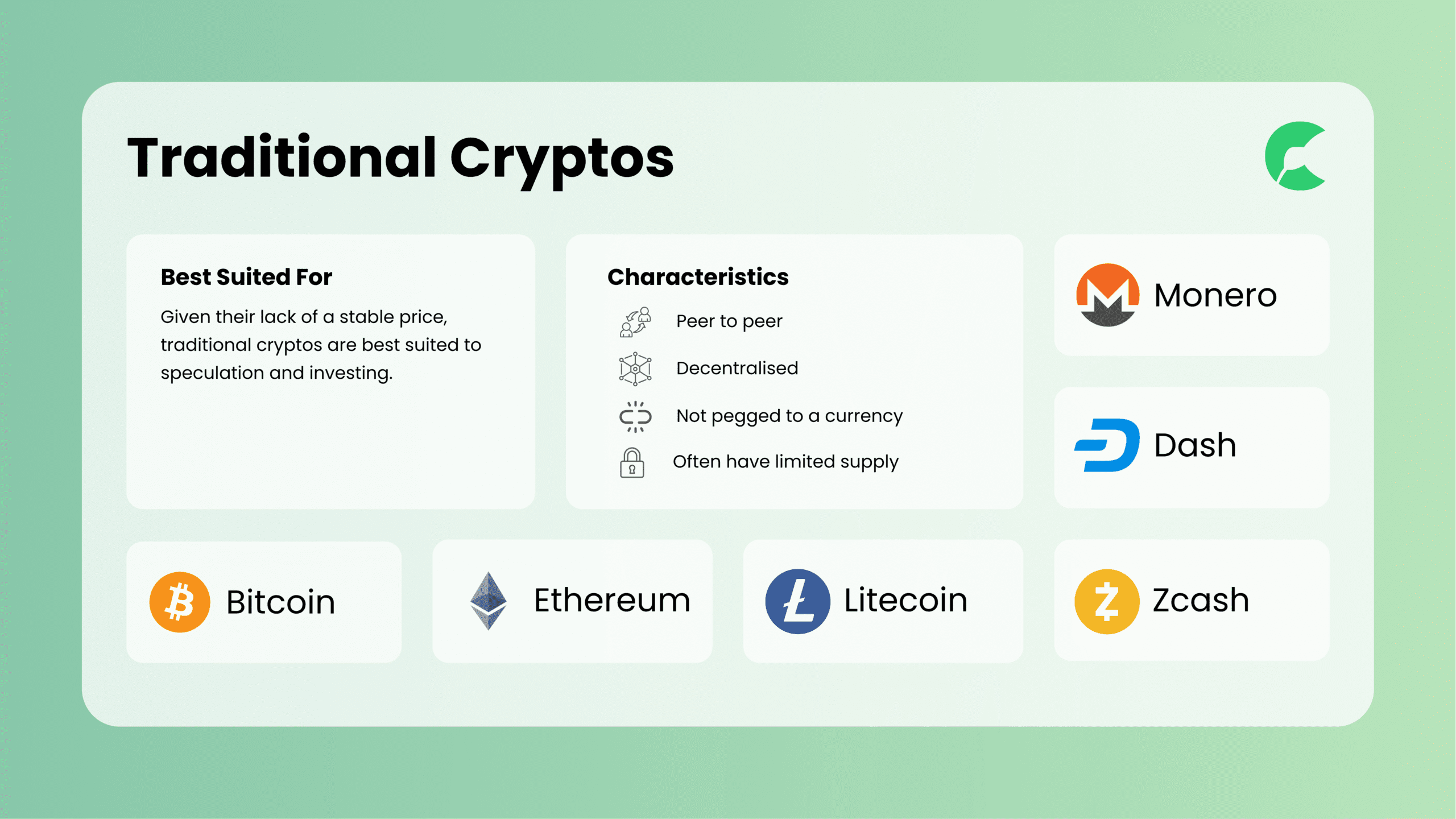

Traditional cryptos

Bitcoin falls into this category, along with many other cryptos. They have a number of defining features. Firstly, they are peer-to-peer payments, meaning users trade between themselves, much like how an individual buyer using TradeMe purchases something from an individual seller.

Secondly, they are decentralised, meaning there is no single authority that controls the crypto.

Thirdly, they are not pegged to a currency, meaning they do not retain a fixed exchange rate with any other crypto or traditional currencies like the NZD.

Lastly, they often (but not always) have a limited supply.

Given their lack of a stable price, traditional cryptos are best suited to speculation and investing.

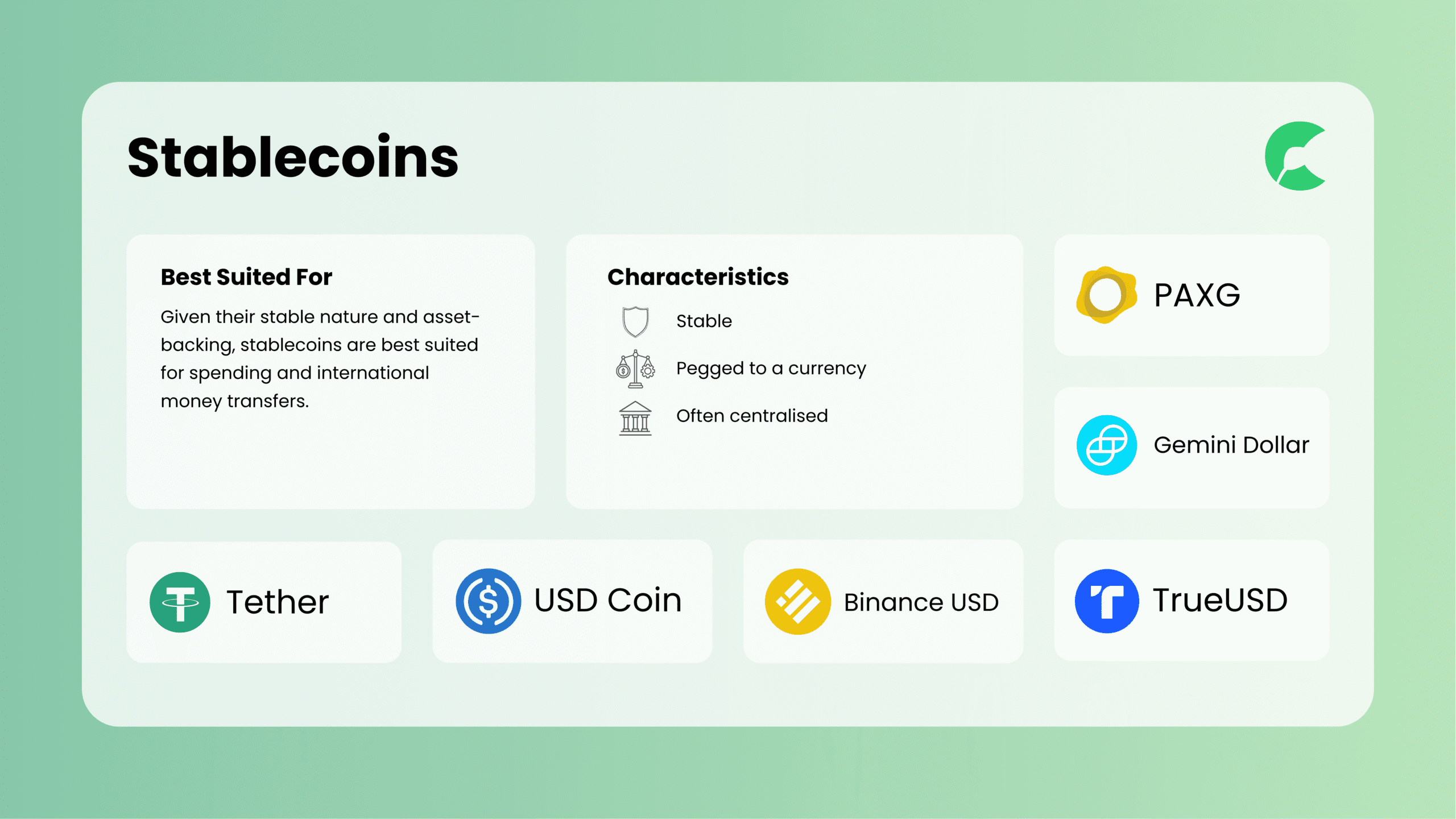

Stablecoins

These coins maintain a stable value because these coins are backed by another asset, which is often the US Dollar, but can also be other crypto. In practice, this means owners of these coins can return coins to the issuer, and in return, they will get a predetermined amount of the asset backing the coin.

This works identically to the US Dollar when it was backed by gold. At the time, for every $35 that was returned to a bank, the owner would get an ounce of gold. While the USD is no longer backed by gold, the very same principle still applies to stablecoins today.

Most stablecoins are not decentralised. The implication of this is that a purchaser must have confidence that the issuer of stablecoins is trustworthy, and will still exist when they want to redeem their coins for the asset backing them.

Given their stable nature and asset-backing, stablecoins are best suited for spending and international money transfers.

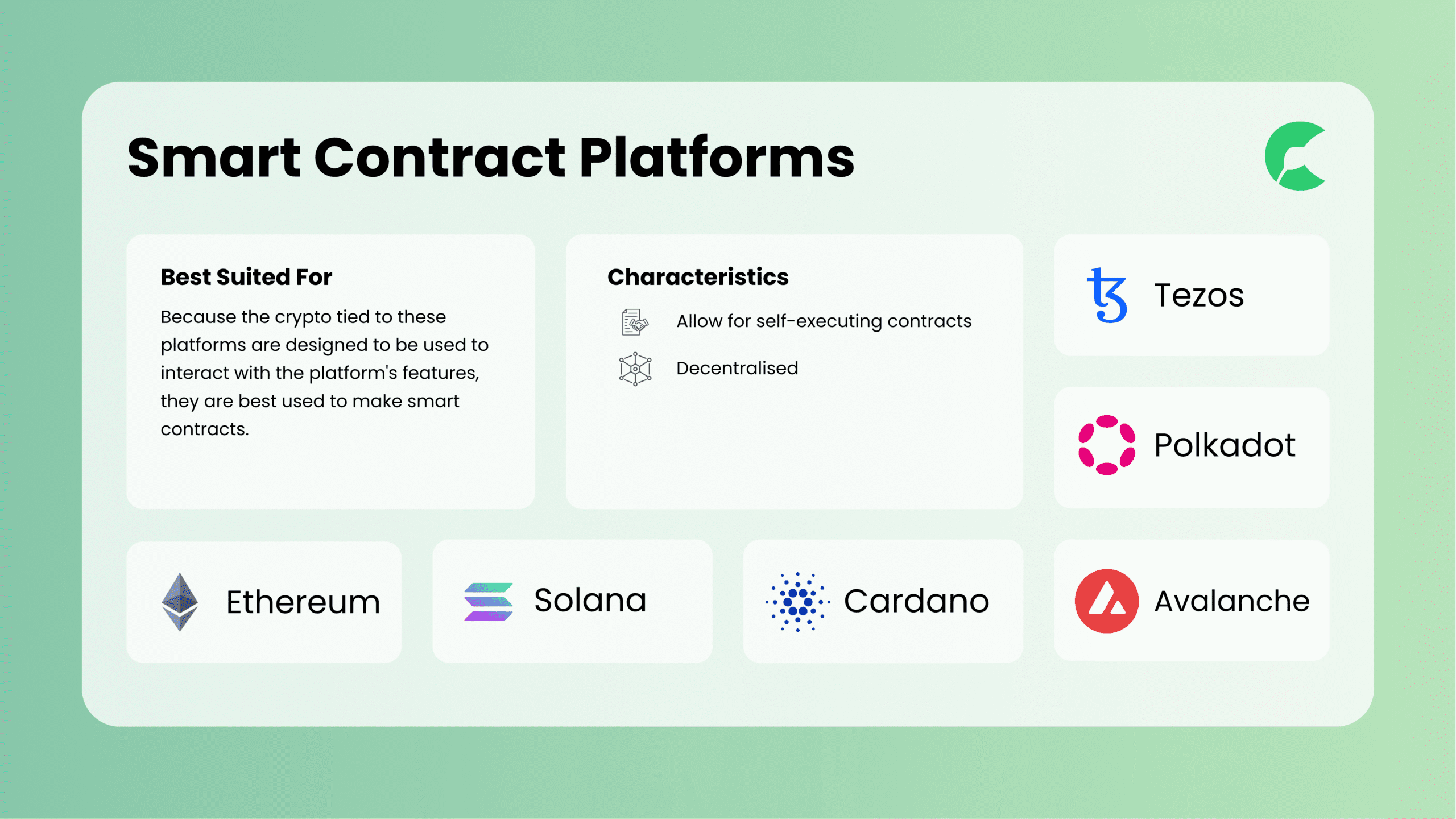

Smart contract platforms

Ethereum and Solana are both examples of smart contract platforms with their respective currencies being Ether and SOL. Smart contracts are self-executing contracts between the buyer and seller written into lines of code.

While the currencies of these platforms can be used for peer-to-peer payments, they are intended more to facilitate the creation of smart contracts. Smart contract creation requires a fee that is paid in the currency of the platform.

Because the cryptos tied to these platforms are designed to be used to interact with the platform’s features, they are best used to make smart contracts.

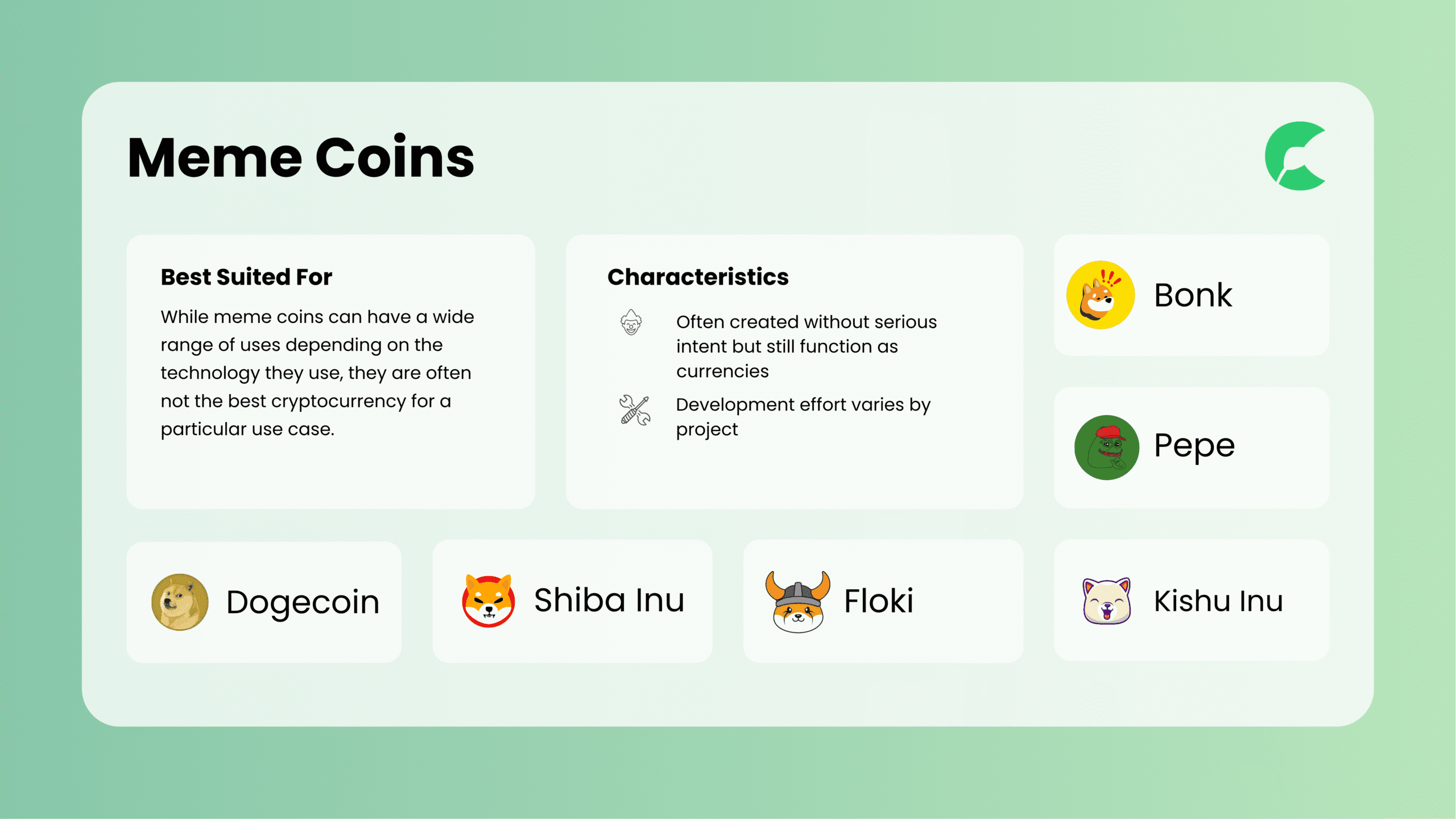

Meme coins

These are created without intent to become a serious crypto. For example, the most noteworthy meme coin, Dogecoin, was created because founders Billy Markus and Jackson Palmer thought that “cryptocurrency was being taken far too seriously and wasn’t much fun”.

Some meme coins have development teams supporting them while others don’t. Furthermore, many meme coins create a new crypto using the technology of another, a process known as forking.

While meme coins can have a wide range of uses depending on the technology they use, they are often not the best crypto for a particular use case.

Final Thoughts

Blockchain technology has a broad set of applications beyond just crypto but has the most benefit where trust is needed in a decentralised environment. Blockchain technology has spawned the creation of countless cryptos, which generally fall into four categories.

Blockchain and crypto could have a big impact on the world, but any impact will be concentrated in a very small number of projects. Profitable investors will be able to identify these cryptos while avoiding the countless scams.

There is no regulatory oversight of crypto so protecting yourself from these scams comes down to good research and maintaining a healthy scepticism when you hear about “the next big crypto”.

If you’re considering investing in crypto, take the time to understand what the crypto aims to achieve, how it will compete with other crypto, the quality of the team supporting its development and how it will sustain itself.

If you’re looking for a good starting point, read our Should I Buy Bitcoin, or How to Buy Bitcoin in New Zealand pages to continue on your journey to owning your first crypto.