Some investors want to benefit from appreciating crypto prices without directly owning digital currencies like Bitcoin or Ethereum.

You gain potential upside from crypto prices without needing to manage wallets, private keys, or risk losing access to your digital assets.

On the downside, the price movement of other assets may not directly track the crypto you are trying to get exposure to.

Recommendations

Holding crypto directly has the lowest fees, ensures you will receive exactly the returns of a given crypto, and gives you access to all available cryptos.

Given their tax efficient status for Kiwis earning more than $53,500 annually, crypto PIE funds are the best option for beginners looking to benefit from price increases in crypto without holding crypto directly. To find the best Bitcoin ETF for you read our guide on the best Bitcoin ETFs in New Zealand.

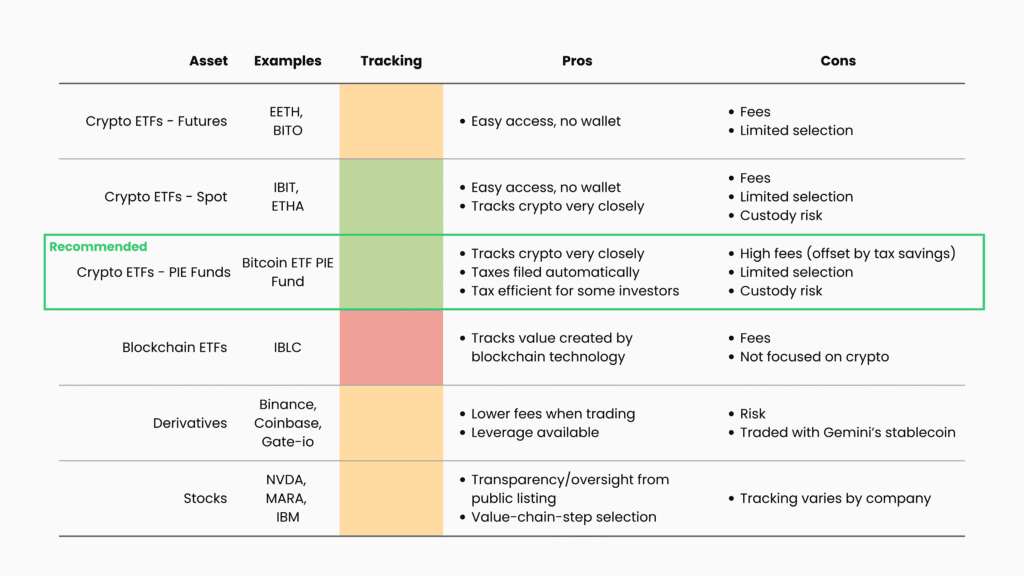

For a summary of the available assets, please see the table below. For each asset type, examples, tracking quality (how well the asset tracks the underlying crypto it is trying to match), pros, and cons are presented.

For more detailed information of all the assets and a further breakdown of stocks that are exposed to crypto, please keep reading.

Options for Indirect Crypto Exposure

This section will look at all the options available to New Zealand-based investors looking to get exposure to crypto without owning it directly.

For each option, it will discuss how it tracks crypto, how well the option tracks crypto (and where possible, which crypto it tracks), its pros, cons, and some examples.

Crypto Exchange Traded Funds (ETFs)

There are two types of crypto ETFs, spot ETFs and futures ETFs.

While both will give investors exposure to their respective underlying asset and neither require investors to manage their crypto wallet or private keys, they have unique trade offs.

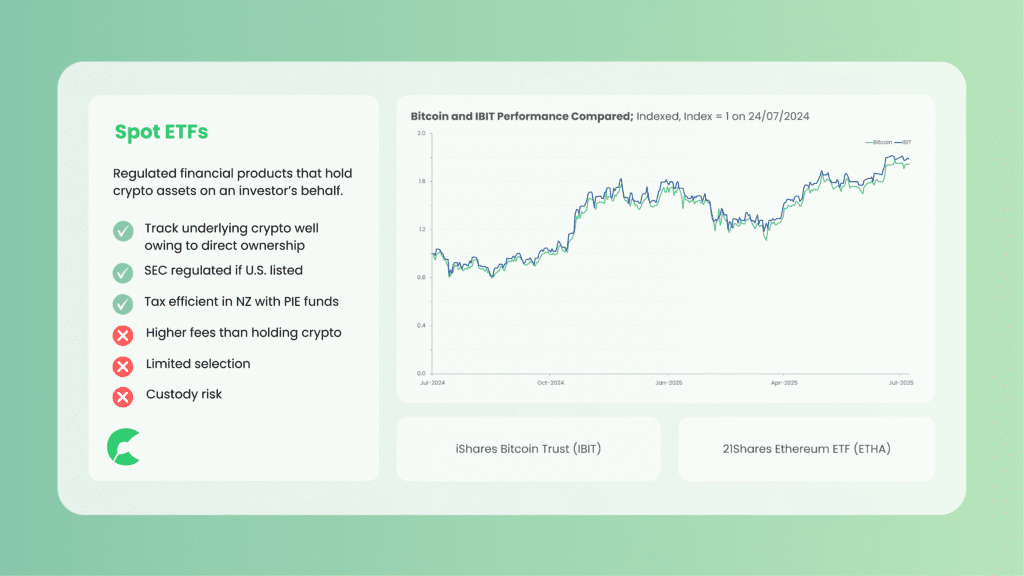

1. Spot ETFs

Spot ETFs hold the underlying crypto directly.

For this reason, they track the price of the underlying crypto very closely. For very small holdings, they may be more cost effective than holding crypto directly as there are no storage-related fees (e.g., hardware wallet cost).

Spot crypto ETFs are regulated by the SEC in the U.S. if listed there. Spot Bitcoin ETFs were approved by the SEC in 2024.

The biggest downside to spot ETFs is their custody risk. As you might recall from Crypto Wallets: A Beginner’s Guide, there is a common saying amongst crypto investors – “not your keys, not your coins”. While unlikely, it is possible the ETF manager loses access to the private keys of the crypto held by the ETF.

Lastly, while there are thousands of cryptos available, spot ETFs are limited to the most popular cryptocurrencies. Investors looking to purchase less popular cryptos will have to do so directly.

Examples of spot ETFs available to New Zealand investors include IBIT (iShares Bitcoin Trust) and ETHA (21Shares Ethereum ETF).

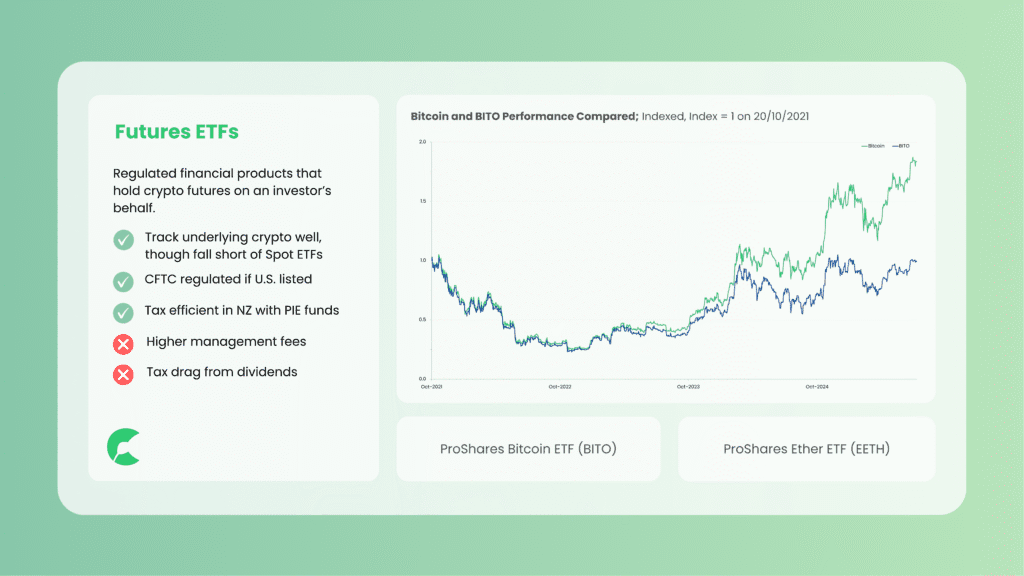

2. Futures ETFs

Instead of holding actual crypto in a wallet on behalf of ETF owners, futures ETFs hold futures.

Futures are a contract between a buyer and seller that obligates the buyer to purchase or sell an asset at an agreed upon price in the future.

Futures ETFs are regulated by the CFTC, preventing fraud, manipulation and abusive practices in the futures market.

Because they do not hold crypto directly, futures ETFs do not track the price of the underlying crypto as closely. Additionally, to offset the effort required to buy and sell futures, these ETFs typically have higher management fees.

Because futures ETFs pay profits from sold futures as dividends, they are not very tax efficient, especially for Kiwis in higher income tax brackets.

Examples of futures ETFs available to New Zealand investors are ProShares Ether ETF (EETH) and ProShares Bitcoin ETF (BITO).

3. NZ PIE Funds

NZ PIE funds hold units of other spot ETFs rather than holding crypto assets directly.

While they have higher management fees as a result, for Kiwis earning more than $53,500 annually, the tax benefits of a PIE fund will more than offset this higher fee.

Additionally, PIE funds will handle investors’ tax reporting requirements, with no tax calculations required by the investor.

Given their ownership of spot ETFs, their tracking performance of crypto prices will be exactly the same with the exception of slightly higher fees. All the other pros and cons remain the same as spot ETFs.

The Bitcoin PIE Fund ETF (previously called Vault International Bitcoin Fund), is one such example of a PIE fund holding spot ETFs.

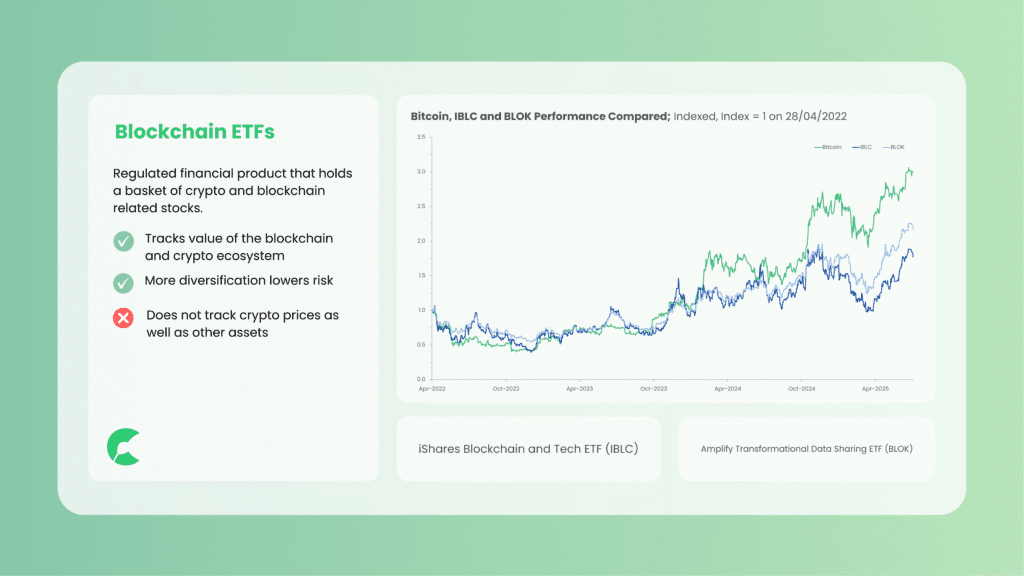

Blockchain ETFs

Blockchain ETFs do not aim to track the performance of crypto but rather of companies using blockchain technology. This is for investors that believe in blockchain but want some diversification beyond just cryptocurrencies.

Owing to their more diversified nature, blockchain ETFs will experience lower volatility than crypto ETFs. This might make them appropriate for more risk-sensitive investors who still want exposure to blockchain technology and cryptos.

Some blockchain ETFs include companies only tangentially related to blockchain, making their correlation to crypto performance inconsistent.

For example, Amplify Transformational Data Sharing ETF (BLOK), an actively managed fund that invests at least 80% of its net assets in the securities of companies actively involved in the development and utilisation of blockchain technologies, also invests in companies that run crypto mining operations.

This might appeal to investors seeking broader exposure, but other investors might want investments more targeted to certain parts of the blockchain/crypto value chain.

Another example of a blockchain ETF is IBLC.

Derivatives

Derivatives are financial instruments whose value is based on an underlying asset like Bitcoin or Ethereum.

Common derivatives include futures contracts, call options, and put options. You never own crypto directly with derivatives – they are synthetic trades based on price movements. Instead, you are purchasing a derivative contract from another party, known as a counter-party.

Derivatives are complex and high-risk owing to their natural leverage. Leverage means that gains and losses are amplified – small price changes in crypto can result in large swings in the value of the derivative. Derivatives are not suitable investments for beginners.

There are also tax implications as gains and losses from each purchase and sale will be taxable under income tax rules. If you trade crypto derivatives, keep detailed records of your trades as you will need it come tax time.

Derivatives can be traded on Binance, Coinbase and Gate-io.

Stocks

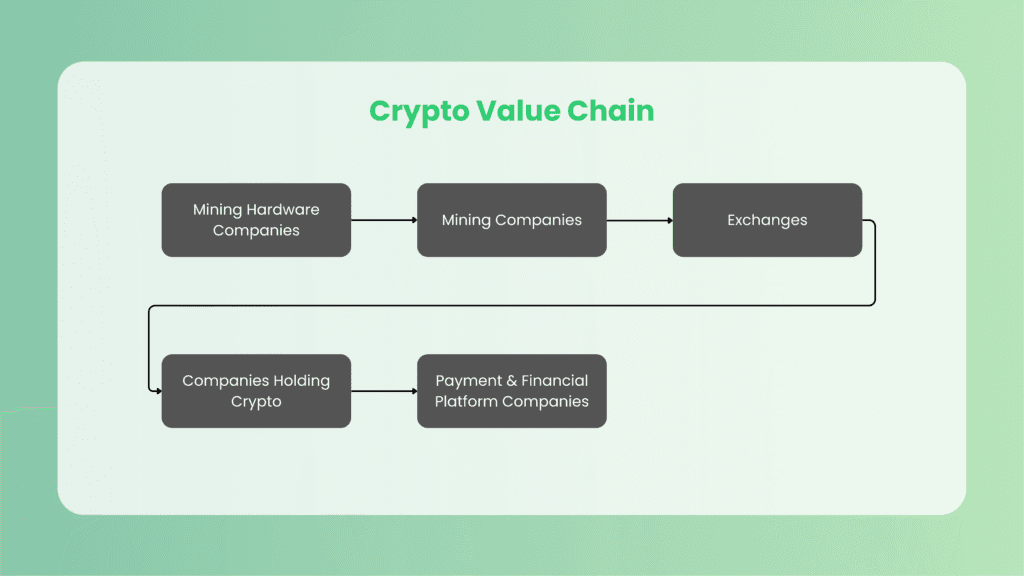

The crypto value chain is diverse and there are many publicly listed companies occupying each step in this value chain.

Because companies with publicly listed stocks have mandated reporting requirements, it is much easier to get reliable information on their performance.

While stocks make for a convenient way to benefit from the price appreciation of crypto, they also add an additional layer of complexity.

Stock prices are also responsive to changes in the business’ performance. Time should be taken to understand a business and the environment with which it operates before making a decision to purchase.

A common advantage shared by all of the stocks discussed below is that they are part of regulated financial markets meaning scams are far less common.

They are also more easily accessible to NZ investors, with many common brokers such as Sharesies, Stake and Hatch offering low fee access to these stocks for everyday investors.

This section will give an overview of the crypto value chain before breaking down each step in more detail.

Crypto Value Chain – Overview

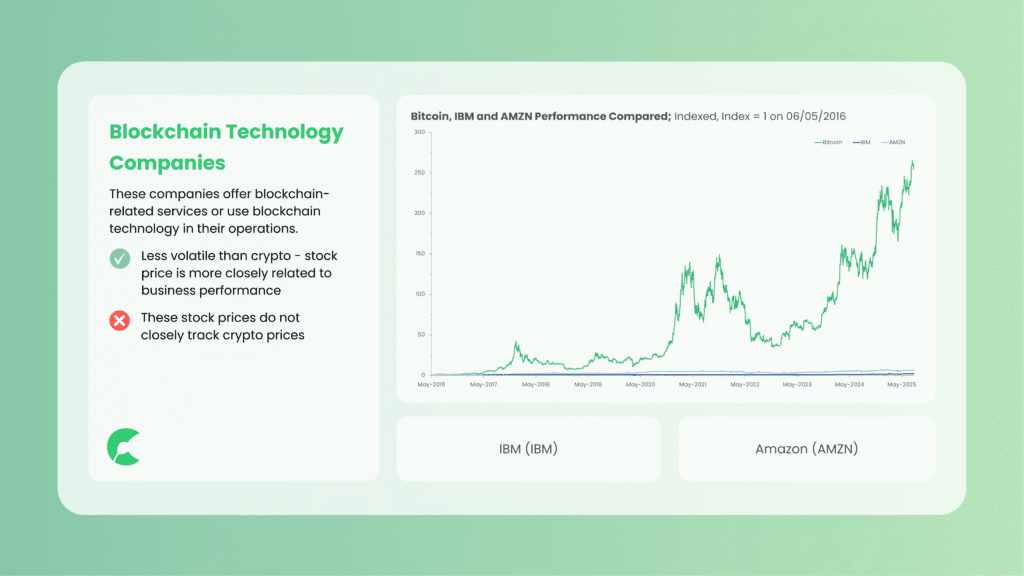

1. Blockchain Technology Companies

These companies either offer blockchain technology services to other companies or use the blockchain in a significant portion of their operations.

These companies are relatively far removed from crypto so their stock prices are unlikely to track any crypto prices very closely. Because of this, these company’s stock prices will generally be less volatile than crypto, instead being more sensitive to changes in the underlying business’ performance.

Examples of blockchain technology stocks include IBM, Amazon and Oracle.

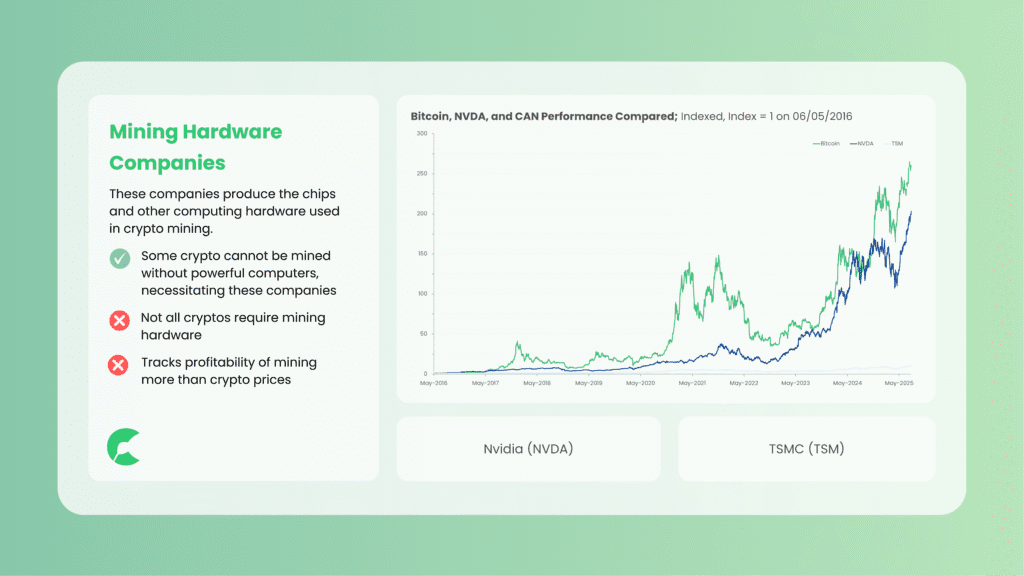

2. Mining Hardware Companies

These companies create the computing hardware required to mine cryptocurrencies, or the chips contained within them.

Only some cryptos need computers for mining, but for those that do, the profitability of mining is influenced by the price of that crypto.

The stocks of companies that produce this mining hardware will naturally track the prices of cryptos that require mining hardware, but the closeness of this tracking will depend on how diversified the revenue streams of the company are.

Some mining hardware has been designed specifically with the sole purpose of mining crypto, known as Application-Specific Integrated Circuits (ASICs).

Cryptos can also be mined on general purpose hardware known as GPUs. Different companies make these two types of hardware.

Examples of mining hardware companies are; Canaan Inc, which produces ASICs; Nvidia, which produces GPUs; and TSMC, which produces the physical chips used in all mining hardware.

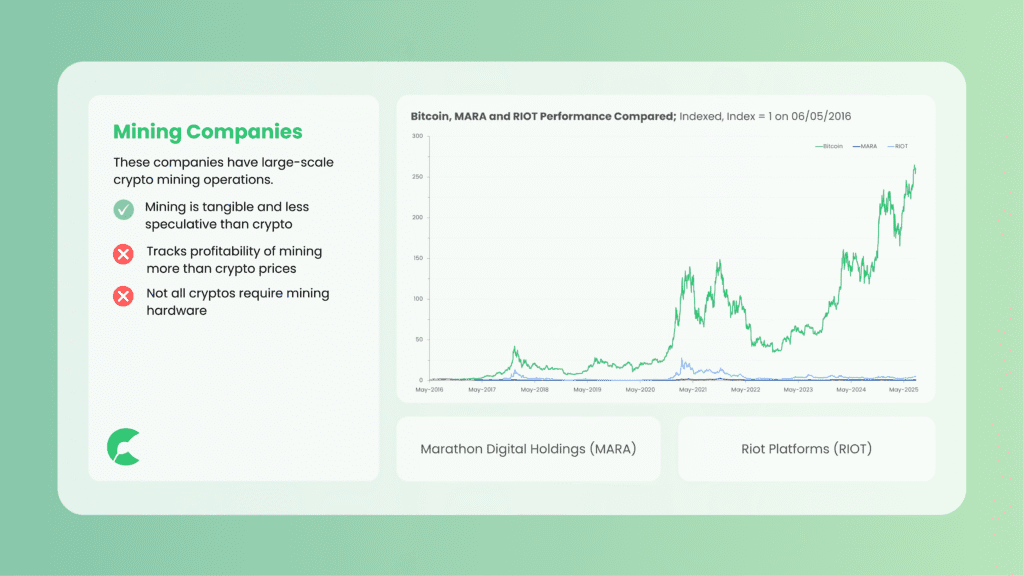

3. Mining Companies

Mining companies run large scale crypto mining operations using the aforementioned mining hardware.

These companies typically operate industrial-scale crypto mining operations in areas where there is underutilised grid power.

Like mining hardware companies, the stock price of mining companies will be more closely tied to the price of cryptos that can be mined, such as Bitcoin.

Because these companies exclusively mine crypto, and do not have other revenue generation activities, their stock prices will more closely track that of cryptos that can be mined.

Because these companies utilise their large scale to lower the price to mine crypto, it might be advantageous for some users to purchase these stocks instead of mining crypto themselves.

This is especially true in countries like New Zealand where the cost of electricity is relatively high.

Owing to the volatile nature of crypto prices, there may be extended periods of unprofitable crypto mining. Given their high cost base, these companies will need to manage their operations well to see these periods through.

Examples of mining stocks include Marathon Digital Holdings (MARA) and Riot Platforms (RIOT).

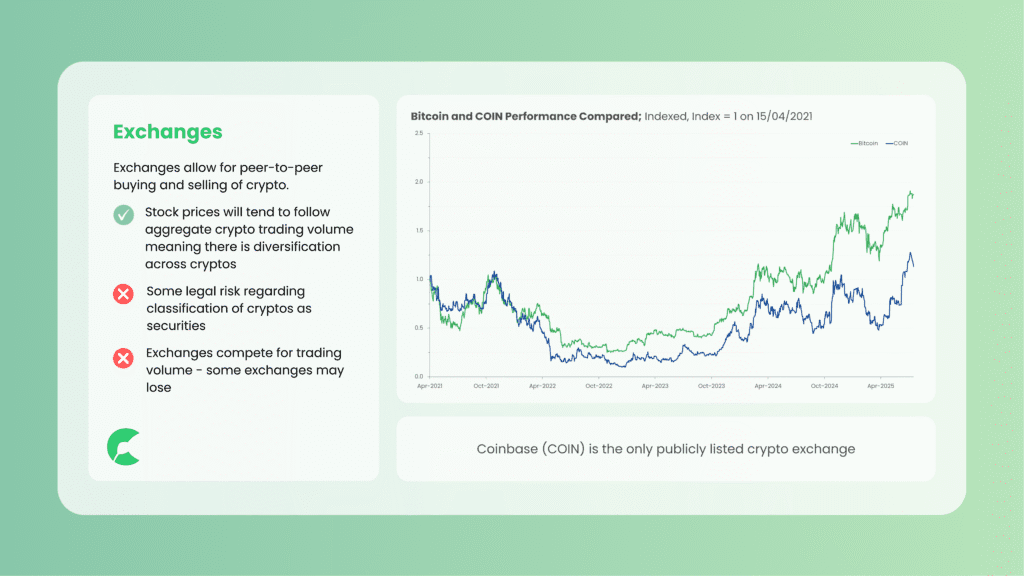

4. Exchanges

Exchanges allow users to buy and sell crypto from each other and capture a fee from the trading volume on their platforms.

While prices have some impact on the trading volume on these platforms, and hence the revenue they earn, volatility in crypto prices is a more representative driver of their revenue.

Exchanges also have other revenue streams such as debit/credit cards, savings and loans.

Because the large exchanges allow users to purchase most cryptos, the stock prices of these exchanges will tend to track aggregate crypto volume, making them a good choice for investors looking to invest in crypto, without having to choose a specific crypto.

On the flip side, there are a few exchanges competing for volume with each other. By investing in a specific exchange, you are betting that particular exchange will win in the long-term.

While currently operating lawfully, there remain legal hurdles for crypto exchanges to clear.

Most notably, the SEC sued Coinbase in 2023 alleging the sale of tokens that should be registered as securities. While this lawsuit was later dropped, there remains significant regulatory risk for exchanges.

The only reputable crypto exchange that is currently publicly listed is Coinbase (COIN).

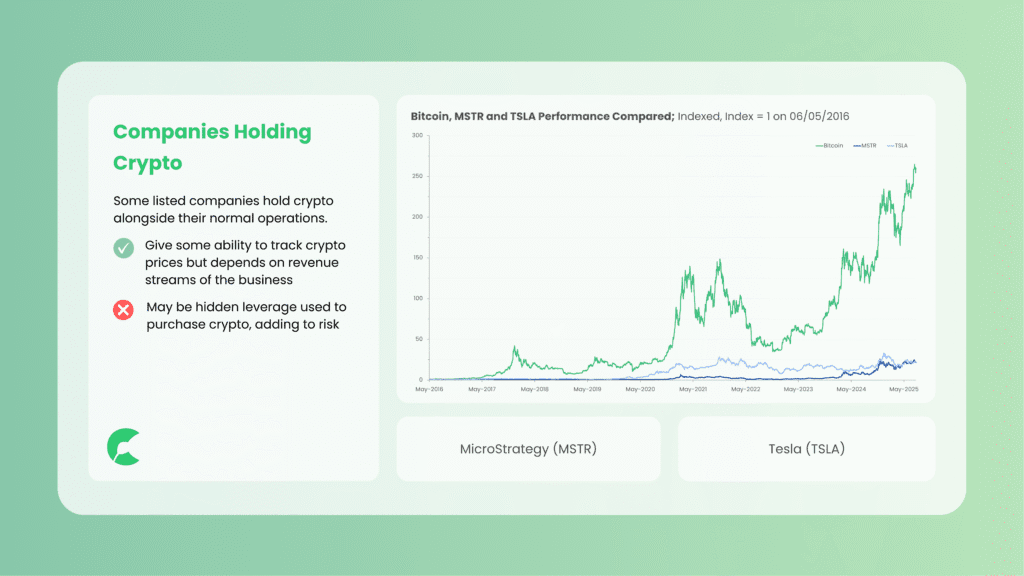

5. Companies Holding Crypto

Some companies have indicated their long-term faith in crypto and have started accumulating a large portfolio.

The reason for these companies acquiring Bitcoin largely falls into two buckets.

Firstly, some companies such as MicroStrategy believe that Bitcoin is an inflation hedge.

Secondly, some crypto miners such as Marathon Digital Holdings are speculating that Bitcoin will continue to appreciate.

The price of these stocks will most closely track the price of the crypto they are holding, which in most cases is Bitcoin.

How closely they track the crypto price depends on how diversified their operations are, with the Bitcoin holdings of companies like Tesla being relatively small compared to the size of the business.

While these companies give investors the opportunity to get moderate exposure to crypto prices without the hassle of owning crypto, they introduce additional costs in the form of salaries and overheads like rent, likely reducing the profitability compared to just holding crypto directly.

Further, a subset of the companies that own crypto are buying crypto with debt, increasing their leverage and subsequently the risk. Investors therefore, might be taking on more financial risk than they may be prepared to manage.

Examples of companies that own crypto are MicroStrategy (MSTR), Tesla (TSLA), and Block Inc (SQ).

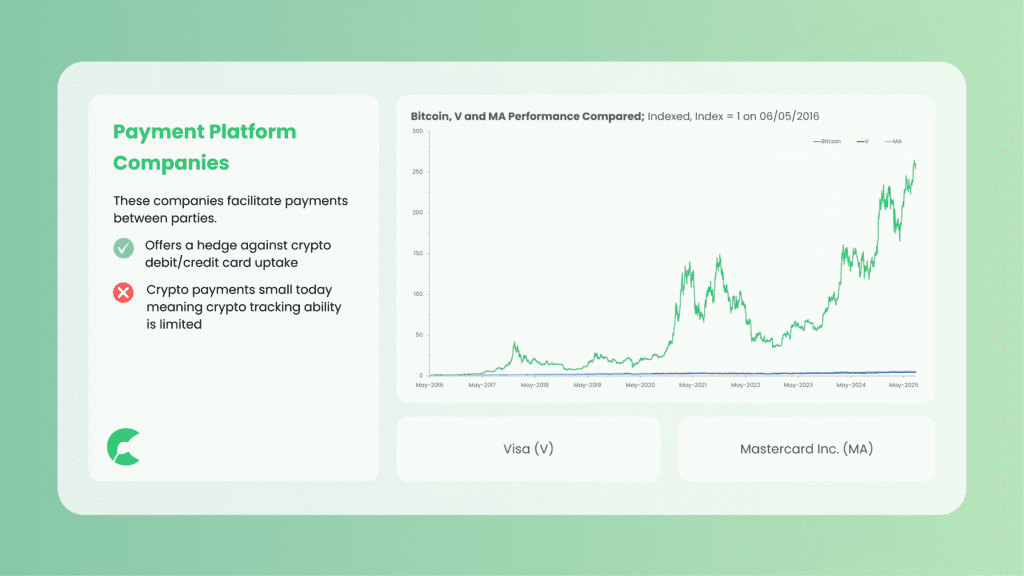

6. Payment and Financial Platform Companies

Payment platforms like Visa and Mastercard have minimal exposure to crypto prices, but they are building infrastructure for crypto-linked payments and stablecoin settlement.

They partner with exchanges like Binance, Coinbase and Crypto.com to issue crypto debit and credit cards that let users spend crypto which is instantly converted to fiat at the point of sale.

These partnerships provide modest exposure to crypto trends, but depend on crypto card adoption for meaningful impact.

The current exposure to crypto through these companies is very small given the small volume of payments made through crypto cards compared to traditional bank-issued debit and credit cards.

How to Buy These Assets

For financial assets that are available through public markets, which includes ETFs and stocks, the best way to buy is through a share broker that allows access to U.S. stocks

In New Zealand, this includes Sharesies, Hatch, ASB Securities, InvestNow, Stake and Interactive Brokers.

For beginners, we recommend Sharesies, Hatch, or Stake.

For more advanced investors who want the lowest fees and access to the most international stock exchanges, we recommend Interactive Brokers.

Conclusion

There remains a plethora of options for Kiwi investors who want to benefit from crypto’s price increases but do not want to buy crypto directly.

While direct crypto ownership offers the most precise tracking of price movements with the lowest fees, it comes with higher custody and security responsibilities.

For investors that want some diversification, want to choose an exposure level that suits their investment philosophy, and are willing to spend the time it takes to thoroughly research companies before investing, stocks remain an attractive option.

Investors who prefer a hands-off approach can choose diversified ETFs that align with their risk tolerance and investment goals.

For most Kiwis, a PIE fund will be the best option with its tax efficiency advantages and lower tax administrative effort required.

Disclaimer

The information provided on this website is for informational and educational purposes only and should not be considered financial, or any other, professional advice. We do not provide personalised investment advice, financial recommendations, or endorsements of any particular financial products or strategies discussed in this article.

You should conduct your own research and consult a qualified financial advisor before making any financial decisions. The authors of this website do not assume any responsibility for external website content or how the information on this website is used.