In our recent article Investing in Crypto Without Owning It, we explored different options for Kiwis to gain exposure to Bitcoin’s price movements without directly holding coins.

One option we highlighted was Portfolio Investment Entity (PIE) funds. These are an investment structure unique to New Zealand that can offer tax advantages and remove the burden of securing your own crypto.

In this guide, we break down the best Bitcoin PIE funds available in New Zealand. We compare their fees and holdings, explain how they work, and see how they stack up against US-listed Bitcoin ETFs.

Summary

Bitcoin PIE funds are not the right choice for every investor, but they offer a simple and tax-efficient way for New Zealanders to get exposure to Bitcoin without managing private keys or overseas accounts.

They are best suited for investors:

- Expecting >5% annual Bitcoin returns

- Comfortable with Bitcoin held by a managed fund rather than holding personally

- Earning over $53,500 who benefit from the 28% PIR tax cap

- Wanting to avoid Foreign Investment Funds (FIF) reporting – no $50k foreign investment threshold applies

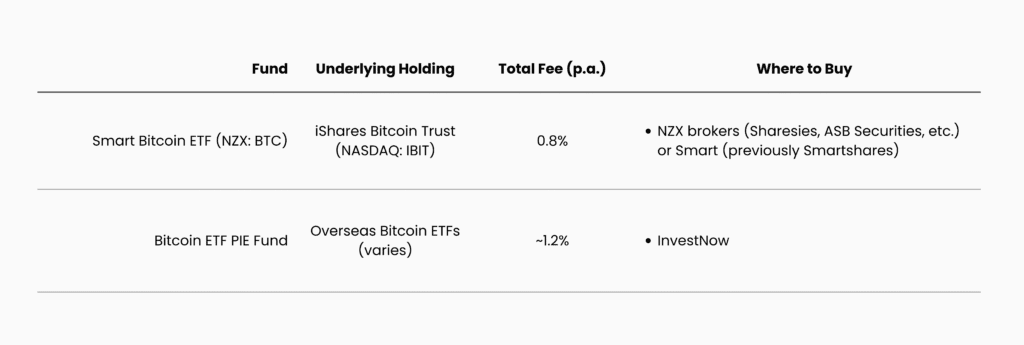

The below summarises the options available to Kiwis:

What are PIE Funds

Portfolio Investment Entities (PIEs) are a common investment structure in New Zealand. ETFs in New Zealand are generally structured as PIEs for their tax benefits and simplicity for investors.

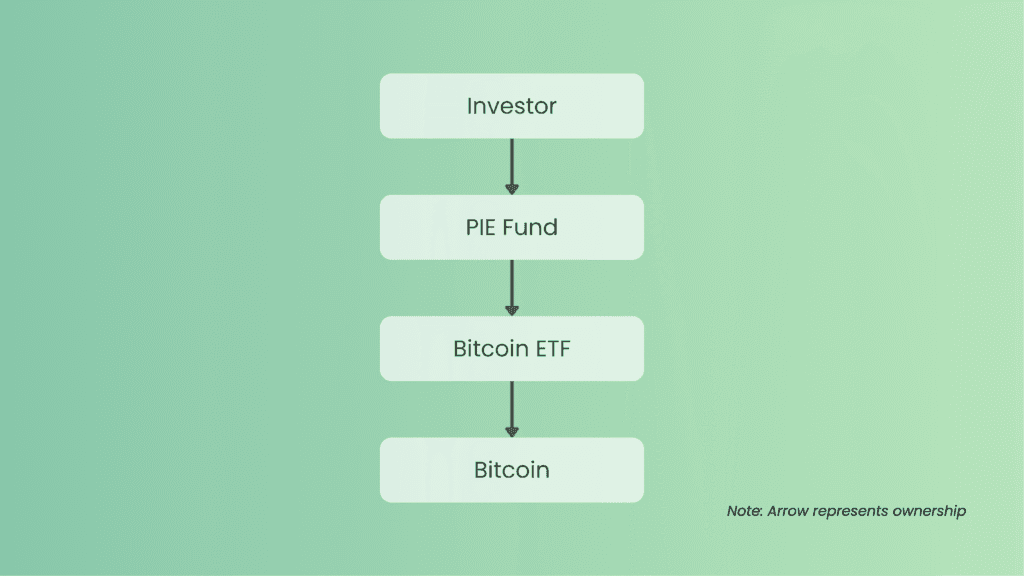

When investing in a PIE fund, you buy units of the fund (like owning shares in a company).

Virtually every Bitcoin PIE fund invests in US-listed Bitcoin ETFs rather than holding Bitcoin itself. The Smart Bitcoin ETF (NZE: BTC), for example, invests in the iShares Bitcoin Trust ETF (NASDAQ: IBIT).

It should be noted that performance can differ noticeably from the underlying US-listed ETFs due to factors like currency movements and tax – more on this later.

Why Invest in Bitcoin PIE Funds

No Self-Custody

When investing in a Bitcoin PIE fund or any other type of Bitcoin ETF, the fund manages the coins on your behalf. While you technically don’t own Bitcoin this way (it’s held on your behalf), it is a great hands-off approach that doesn’t require securing your own crypto.

Tax Benefits

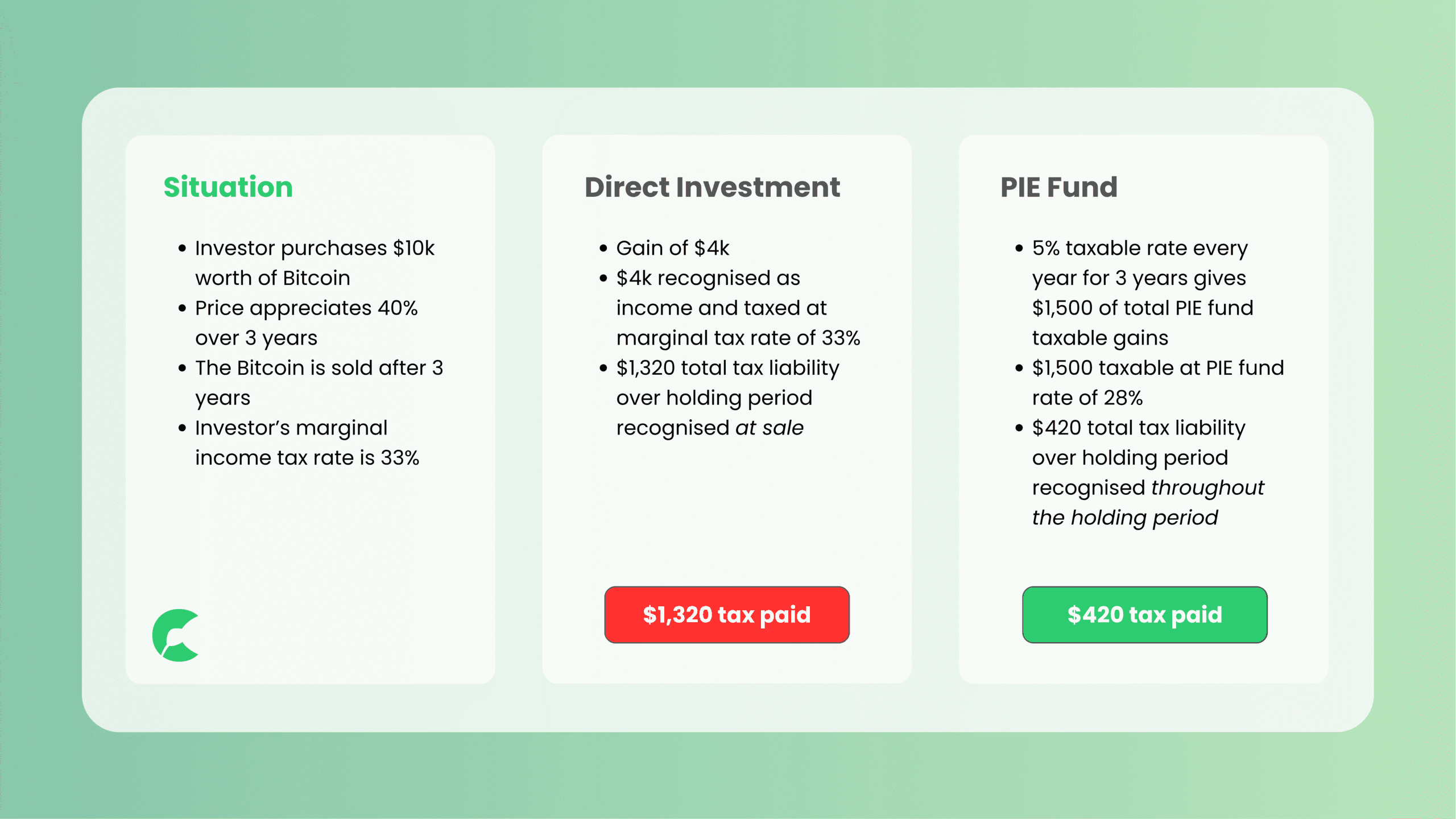

One of the biggest advantages of Bitcoin PIE funds is their taxation.

As mentioned earlier, you are taxed at your Prescribed Investor Rate (PIR), which is capped at 28%. This is beneficial for anyone earning over $53,500, where personal tax rates can be as high as 39%.

Furthermore, because PIE funds use the Fair Dividend Rate (FDR) method, you are taxed on an assumed 5% annual return, not your actual gains. This can make a big difference in strong years for Bitcoin.

An important consideration is that with direct holdings, gains are generally only taxed when you sell, but with PIE funds, tax is calculated and paid each year regardless of whether you’ve sold.

This works in your favour during strong years, as you’ll likely pay tax on far less than your actual gains, but it can be a disadvantage in losing years as you will still pay tax on the 5% assumed return even if your investment has lost value.

Over the long term, if returns average above 5%, as many Bitcoin investors would expect, this method will likely result in lower overall tax, otherwise an investor may be worse off.

Simplicity

Investing in a Bitcoin PIE fund is a less stressful option, with no need to manage private keys, wallets, or overseas accounts.

You can buy units through your usual NZX broker, like Sharesies or Hatch, or directly from the fund manager.

Tax is calculated and paid by the fund, so there’s nothing to add to your tax return. PIE funds also avoid the Foreign Investment Fund (FIF) rules, which can otherwise apply to overseas investments greater than $50,000 and require complex annual calculations on gains.

How PIE Funds Compare US-Listed Bitcoin ETFs

Underlying Holdings

PIE funds in New Zealand are generally just wrappers holding US-listed Bitcoin ETFs. Rather than holding Bitcoin directly, they invest into Bitcoin ETFs listed on US stock exchanges. These US-listed Bitcoin ETFs invest directly into Bitcoin.

The below compares the holdings of the New Zealand domiciled Smart Bitcoin ETF (NZE: BTC) with the US domiciled iShares Bitcoin Trust ETF (NASDAQ: IBIT).

Fees

When you invest in a NZ-listed Bitcoin PIE fund, you are effectively paying two layers of fees.

First, there’s the PIE fund’s own management fee i.e., the fee charged by the Smart Bitcoin ETF. For most investors this fee is more than offset by the tax savings.

On top of that, the underlying US-listed Bitcoin ETF also charges its own fee, which is deducted before returns flow through to the PIE.

While you won’t see the underlying fund’s fee as a separate charge, it is built into the overall performance.

Currency Impact

NZ-listed PIE funds are priced in NZD, but their underlying investments are in USD.

This means your returns will reflect movements in both the Bitcoin price and the NZD/USD exchange rate.

In practice, the fund’s performance will generally be similar to Bitcoin priced in NZD, rather than Bitcoin priced in USD.

Tax Impact

US-listed Bitcoin ETFs typically only trigger a taxable event when you sell your units, meaning gains are realised at that point.

In contrast, Bitcoin PIE funds calculate and pay tax internally each year under the Fair Dividend Rate (FDR) method, regardless of whether you sell.

This tax is paid directly out of the fund’s assets, so the returns you see for a PIE are already net of both management fees and annual tax.

Performance Comparison

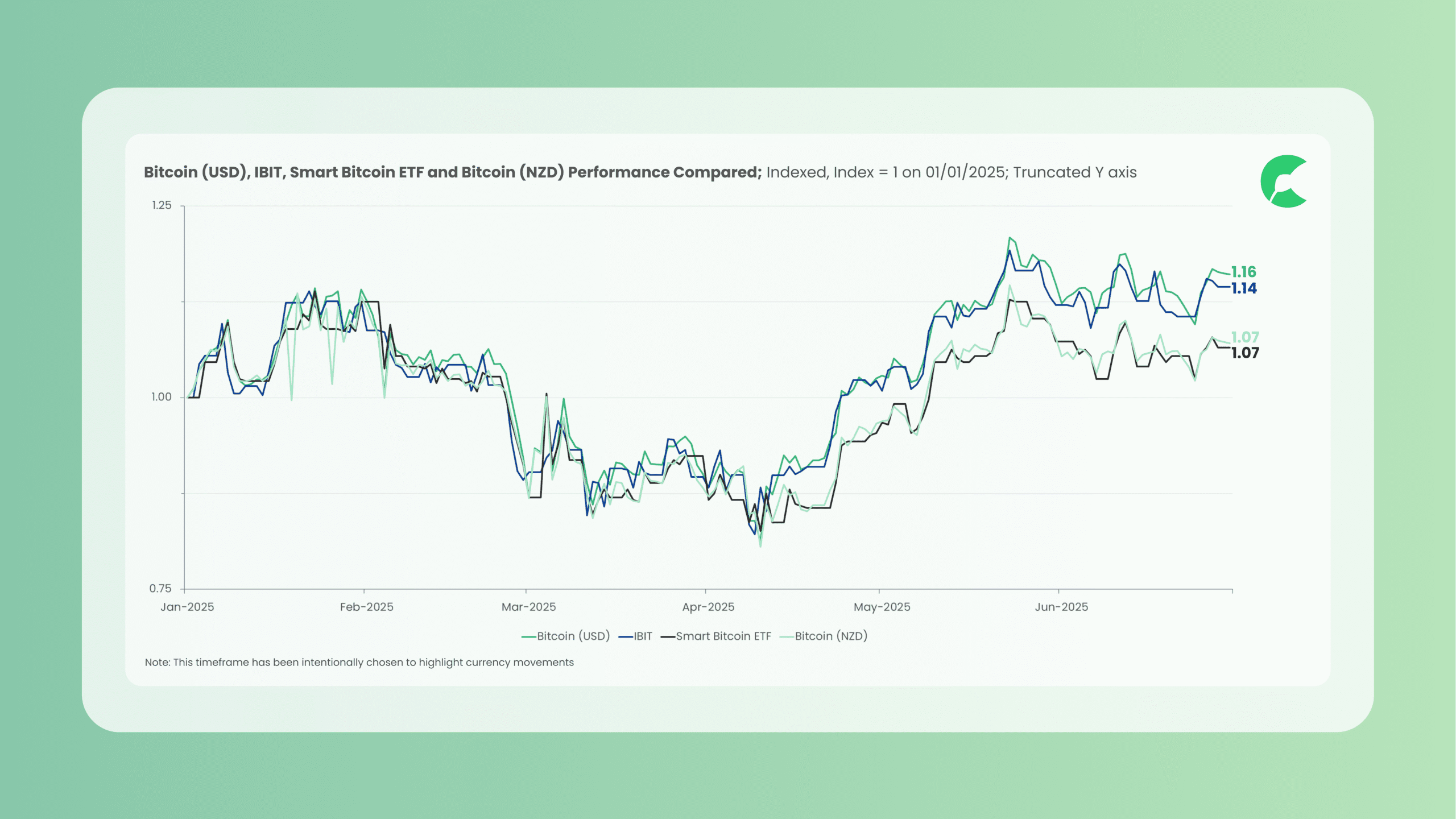

The below compares the performance of:

- Bitcoin (USD) and IBIT

- Bitcoin (NZD) and Smart Bitcoin ETF

This comparison takes into account the combined impact of fees, currency, and internal taxation of the Smart Bitcoin ETF.

The relatively short timeframe of January – June 2025 was chosen to demonstrate the strong impact currency movements can have.

During this timeframe the USD dropped significantly against the NZD which is why the NZD denominated Smart Bitcoin ETF underperformed against the underlying IBIT ETF.

This comparison demonstrates that while, both US and New Zealand Bitcoin ETFs, aim to track Bitcoin, their performance can differ significantly.

While the impact of fees and taxation should generally be constant over time, currency movements between the USD and NZD can cause fluctuations between the performance of NZ-listed and US-listed Bitcoin ETFs. The same currency impact would be incurred when buying Bitcoin directly with NZD.

Best Bitcoin PIE Funds in New Zealand

New Zealand investors have two main Bitcoin PIE fund options:

- The Smart Bitcoin ETF (NZX: BTC), a listed PIE ETF managed by Smart Ltd investing directly in the iShares Bitcoin Trust

- The Bitcoin ETF PIE Fund, a managed PIE fund by FundRock NZ and Raise Investments that invests in a variety of overseas Bitcoin ETFs.

Issuer / Manager

- Smart Bitcoin ETF: Smartshares Ltd

- Bitcoin ETF PIE Fund: FundRock NZ (issuer) / Raise Investments (investment manager)

Smart is a prominent NZ ETF provider, while FundRock and Raise bring managed fund experience to the Bitcoin ETF PIE Fund.

Underlying Holding

- Smart Bitcoin ETF: iShares Bitcoin Trust (NASDAQ: IBIT)

- Bitcoin ETF PIE Fund: Overseas Bitcoin ETFs (varies)

Both funds invest indirectly via US-listed Bitcoin ETFs, with Smart Bitcoin ETF focused on IBIT and the Bitcoin ETF PIE Fund holding a mix of overseas Bitcoin ETFs.

Fees

- Smart Bitcoin ETF: 0.8% p.a. (0.55% management fee + 0.25% underlying ETF fee)

- Bitcoin ETF PIE Fund: 1.2% p.a. (0.95% management fee + 0.25% underlying ETF fees)

Smart Bitcoin ETF offers a lower total fee, making it a more cost-effective option for long-term investors.

Where to Buy

- Smart Bitcoin ETF: NZX brokers such as Sharesies, ASB Securities, or directly via Smart

- Bitcoin ETF PIE Fund: Available on the InvestNow platform

Smart Bitcoin ETF offers wider accessibility through multiple NZX brokers, while the Bitcoin ETF PIE Fund is limited to InvestNow.

Final Thoughts

Investing in Bitcoin PIE funds offers New Zealanders a straightforward and tax-efficient way to gain exposure to Bitcoin without the complexities of self-custody or overseas accounts.

While they won’t suit everyone, these funds provide a hands-off option that removes much of the admin and tax hassle involved with direct crypto investing.

If you prefer to invest in Bitcoin directly, our How to Buy Bitcoin in New Zealand Guide includes everything to get you started.

For other ways to invest in crypto without holding it directly, such as US-listed ETFs, listed companies, or blockchain funds, see our guide: Investing in Crypto Without Owning It.

Disclaimer

The information provided on this website is for informational and educational purposes only and should not be considered financial, or any other, professional advice. We do not provide personalised investment advice, financial recommendations, or endorsements of any particular financial products or strategies.

You should conduct your own research and consult a qualified financial advisor before making any financial decisions. The authors of this website do not assume any responsibility for external website content or how the information on this website is used.